Market Mantra- December 2013.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

December was a month of expectations being different from reality. There was a widely held view that tapering in the US would be deferred for a while, till the new US Federal governor Janet Yellen settled down into her new role. However, after keeping investors guessing for several months on when and how much the US Federal Reserve will taper its $85-billion-a-month bond buying program, the Federal Open Market Committee ( FOMC ) finally decided to start tapering its third round of quantitative easing by $10 billion a month from January 2014 onwards. FOMC made this decision because of the reduction in unemployment since the start of QE3 (quantitative easing) and the stronger non-farm payrolls in recent months. Of course, this means that the US recovery is well on track now, and that is good news for the global economy, considering the significant size of the US economy and consumer.

In India, the widely held view was that continuing his fight against high inflation, Raghuram Rajan would increase interest rates once again to quell inflationary expectations. However, Rajan surprised the markets by maintaining status quo, though he kept his options open, including discussing the possibility of a hike between policy meetings if the data so warranted.

Domestic Equities: The Indian Equity markets saw various ups and downs in 2013 on account of FED tapering concerns and general elections.

For the year to 26th December, BSE Sensex Index gained approx. 8.50% where CNX Midcap lost close to 6 %.

Recently concluded elections of 5 states (MP, Rajasthan, Chattisgarh, Delhi, Mizoram) have seen big gains made by the BJP at the cost of Congress. This has enthused investors as it improves the odds of a likely stable government at the centre following the next general election in 2014. The surprise element of the Aam Aadmi Party (AAP) winning a disproportionate share in Delhi and thereby forming a government, augurs well for the democratic credentials of India.

The last time around, the Fed tapering created its own challenges and volatility but India looks much better prepared now for Fed Tapering due to following factors:

- Current account deficit for FY14 is likely to be around 2.7 percent of GDP, much lower than.

- FII INR debt holding is lower at $20Bn v/s $37Bn than in May 13.

- Accretion of USD 34 billion through FCNR bank deposits against a targeted USD 15 to 20 billion

- Lower oil prices and inclusion of Indian government bonds in JP Morgan Government bond Index- Emerging Markets are other potential positives.

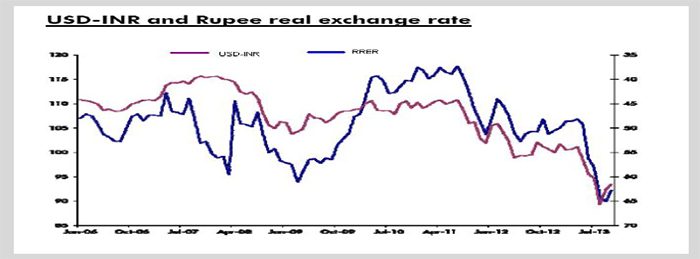

Indian Rupee: The Rupee went through a sharp correction in 2013 on Fed-taper concerns. Recent months have seen much more confidence on the government’s ability to manage the funding shortfall and hence a return in stability of the rupee, as the Rupee valuation has become supportive and the Current Account Deficit (CAD) has come down sharply. Markets are expecting the Rupee to be much more stable in 2014 even as Fed carries out its tapering of QE. Inflation differentials between the US and India will continue to drive the value of the currency moving forward, even though there may be shorter term deviations using this model.

Source: Bloomberg

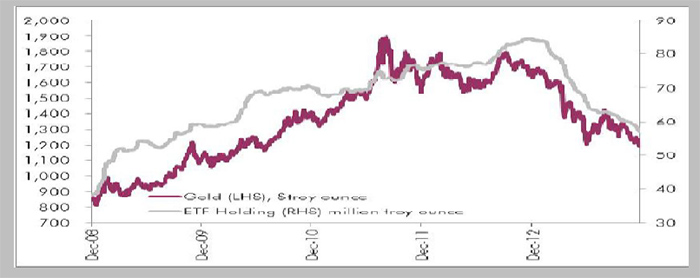

Gold: Gold prices remain under pressure due to both fundamental factors (normalization in US interest rates) as well as technical factors (redemptions from gold ETFs). Gold continues to be an important component of an asset allocation strategy, and should be maintained at 5-10% of the overall portfolio.

Source: Bloomberg.

On Fixed Income: Year to 26th December, 10 Year Government security yield lost close to 14 percent.

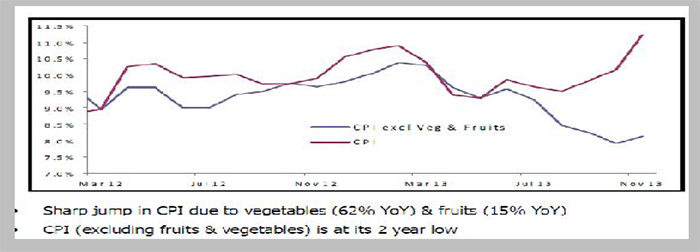

The annual consumer price inflation rose to 11.24 percent in November from 10.09 percent in October, driven by food prices. WPI Inflation rose to 7.52 percent in November from 7.00 percent in October. Hence, it was expected that the RBI may once again raise the repo rate in the monetary policy review on December 18, 2013 which is currently at 7.75 percent. But, RBIs move to keep rates unchanged surprised the markets as it came in contrary to consensus expectations of at least 25 bps hike. However, RBI has chosen to wait for more data as there are indications of vegetable prices turning down sharply as well as the weak state of the economy.

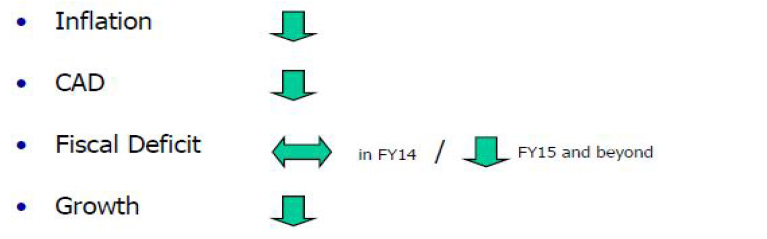

Key drivers of Improving Interest Rate Outlook:

Inflation – sharp moderation likely in Year 2014

Source: CSO, Citi.

CAD (% of GDP) – sharp improvement (2.7% in FY14E Vs 4.8% in FY13)

CAD Deterioration was led mainly due to rising gold imports (2.9% of GDP in FY13 Vs 0.5% in FY08).

| FY12 | FY13 | Q1FY13 | Q2FY13 | Q3FY13 | Q4FY13 | Q1FY14 | Q2FY14 | FY14E | FY15E | |

|---|---|---|---|---|---|---|---|---|---|---|

| CAD(% of GDP) | 4.2 | 4.8 | 4.0 | 5.0 | 6.5 | 3.6 | 4.9 | 1.2 | 2.7 | 2.7 |

| Gold Import(% of GDP) | 3.0 | 2.9 | 2.1 | 2.6 | 3.6 | 3.0 | 3.6 | 0.9 | 1.9 | NA |

Source: Citi, Religare.

Fiscal Deficit Improvement: diesel subsidy is the key.

| FY13 | FY14E | FY15E | FY16E | |

|---|---|---|---|---|

| Per unit Diesel u/r (INR/ltr) | 11.1 | 8.6 | 5.4 | 1.2 |

| Total u/r (Rs bn) on oil products | 1610 | 1406 | 1131 | 817 |

| Under Recoveries (u/r) % of GDP | 1.6 | 1.2 | 0.9 | 0.6 |

Source: Hdfc MF.

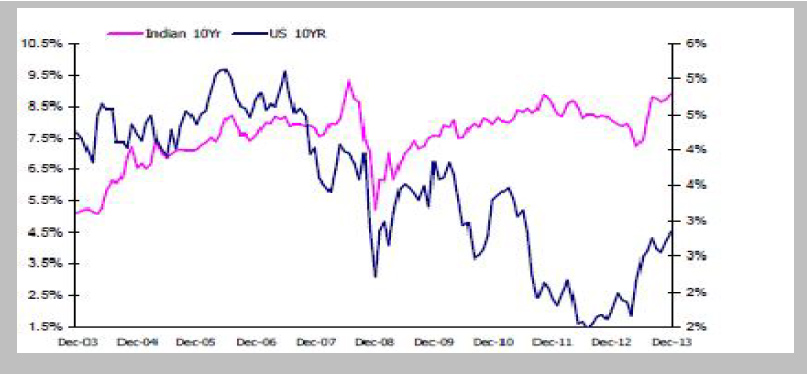

Yield Spread between Indian 10yr G-Sec Yield and 10yr US Treasury Yield is @6% Vs long term (10yr) average of 4.1%

Source: Bloomberg.

Summary of Interest rate drivers – Outlook.

All the above indicators point towards lower interest rates in CY14. Thus adding some component of longer term bonds and duration/income funds can be considered with a 18-24 month view.

US Equities: For the year to 26th December, Dow Jones and Nasdaq gained close to 26 percent and 41 percent respectively. Whilst it has been a spectacular year, the outlook on US equities continues to be positive. However, we are unlikely to see returns in 2014 anywhere close to what 2013 provided. Building a globally diversified portfolio across the US, Europe and Asia continues to be strongly recommended.