Do Sips in Equity Mutual Funds help in goal-based investing?

– Shalini Dhawan, Financial Planner, Plan Ahead Wealth Advisors.

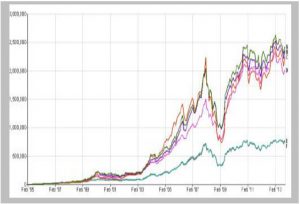

Some days back, in a discussion with a friend of mine, we once again ended up discussing whether mutual funds and in specific whether Equity mutual funds, play any role in goal based investing. Can an investor gather any sizeable corpus by systematic investing? After a lot of discussion and arguements both for and against from her side and mine, I presented to my friend the below example. Suppose you were to invest Rs. 1000 in a SIP in a equity mutual fund from January 1995 till 30 Sep 2013, and invest regularly each month. Simultaneously one could also invest in the Sensex a similar SIP of Rs. 1000 for the same time duration. Once could argue that the returns would depend on the type of mutual fund scheme chosen. So as to avoid being partial to any particular style or scheme, we took the SIP and simulated it over many different types of schemes such as a large cap scheme, a mid cap scheme, a value category scheme and a hybrid equity oriented (balanced) scheme and the Sensex. When we tried to map the values of these SIP investments, the results were as you can see in the graph below.

Can we use SIPs for goal based investing. The answer as we can gather from the above analysis is a big Yes. For all of us who are looking at investing simple small amounts each month, without burdening ourselves with huge commitments, can look at this example as an easy solution to garnering corpuses for long term goals.

| Scheme | Type | Value of Rs 2.25Lakhs | Returns |

|---|---|---|---|

| A | Equity Large Cap Scheme | Rs. 24.3 Lakhs | 21.70% |

| B | Equity Flexi Cap Scheme | Rs 23.5 Lakhs | 21.50% |

| C | Equity Mid Cap Scheme | Rs. 22.4 Lakhs | 21.10% |

| D | Hybrid Equity Oriented Scheme | Rs 20.1 Lakhs | 20.20% |

| E | S&P BSE Sensex | Rs 7.7 Lakhs | 11.90% |

| B | NSE CNX Nifty | Rs. 7.6 Lakhs | 11.70% |

In the simple example above, we figure that an investor by investing Rs. 2.25 Lakhs over a time period of about 19 years, has been able to grow his money from a small Rs. 2.25 Lakhs to a sizeable corpus of Rs. 24 lakhs (in case of scheme A). She has been able to get phenomenal returns in the range of 20-21% each year, depending on the scheme selected (A to D). Even if the investor had invested in either the BSE Sensex or the CNX Nifty (Scheme E or F), she would have made returns in the range of 11% each year.

This brings us back to the moot question. Can we use SIPs for goal based investing. The answer as we can gather from the above analysis is a big Yes. For all of us who are looking at investing simple small amounts each month, without burdening ourselves with huge commitments, can look at this example as an easy solution to

garnering corpuses for long term goals. Of course, there are a few caveats:-

– this example assumes systematic investing of Rs 1000 each month, without fail for the last approx. 19 years, which means riding through both bullish and bearish phases of equities and giving equity investments the time they deserve

– this example also assumes no redemptions have been made from each SIP investment, especially important during bearish phases where most of us contemplate stopping our SIPs

– past performance is not indicative of the future, but history does teach us some important lessons.

So keep investing towards your goals and keep the faith !