Falling Rupee- Kuch Khatta ya Kuch Meetha?

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

Pallavi and Ramesh (names changed on request) were very excited to be moving back to India. Ramesh had recently been offered a position as a business head in the engineering firm that he was working for, and felt that it was great from a career progression perspective, as India was where most major decisions for his company were made. Pallavi was very excited to be going back to a social structure that she had been used to just a few years ago, before she got married to Ramesh and moved out of India. Whilst the infrastructure and quality of life was better overseas than what she experienced during her pre marriage days, she found herself homesick quite often, and missed friends and family. Of course, they were moving to Mumbai and not to Chennai where most of her friends and family were, but a two hour flight was definitely much closer. Since they really had no other links with the foreign country that they were in for the last few years, they had planned to move lock, stock and barrel. As the movement was planned only for the end of 2013, the transition was likely to be gradual.

Each time he remitted money back, he was very pleased for a couple of days, till he discovered that the rupee had fallen even more. After a while, it seemed like the fall in the rupee was a bottomless pit and he decided that the best thing to do was wait. Just as he finalized his wait and watch strategy, the Fed decided that it wanted to delay its tapering program and measures to control the fall of the rupee in India also started to work. All of a sudden, the rupee started to appreciate rapidly and Ramesh was once again left feeling despondent that he had not converted more of his funds into Indian Rupee.

All of a sudden, the world seemed to change. The US Federal Reserve announced that it was likely to starting reducing its bond buying program, more popularly called Quantitative Easing. This led to a surge in the US Dollar and a sharp correction in the currencies of a large number of emerging markets, especially those with high current account deficits like India. As the Indian rupee started falling, Ramesh was very excited. The compensation on his movement back to India was still being worked out, and he felt that a depreciated rupee would mean a higher compensation for him in India. He also started to remit back money at a much more rapid pace to take advantage of the falling rupee.

Each time he remitted money back, he was very pleased for a couple of days, till he discovered that the rupee had fallen even more. After a while, it seemed like the fall in the rupee was a bottomless pit and he decided that the best thing to do was wait. Just as he finalized his wait and watch strategy, the Fed decided that it wanted to delay its tapering program and measures to control the fall of the rupee in India also started to work. All of a sudden, the rupee started to appreciate rapidly and Ramesh was once again left feeling despondent that he had not converted more of his funds into Indian Rupee.

Ramesh connected with me through a referral from one of my existing clients, who also worked for the same company as he did, and explained his predicament on the sharp volatility of the rupee.

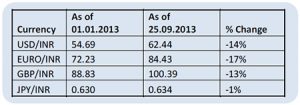

After patiently listening to him, I tried to help him look beyond the recent volatility. In spite of the recent pullback, the rupee had fallen 14 percent against the US dollar since Jan 2013 In fact, it had fallen against most major currencies during the period. The fall has been 17 percent against the euro, 13 percent against the pound and 1 percent against the yen.

Was this fall of the rupee good or bad for Ramesh and Pallavi? Actually, a bit of both as most things normally are.

The good news

Ramesh had a home loan in India for a real estate investment that he had made, for which he was paying a Rs. 50,000 equal monthly installment, or EMI. On January 1, 2013, his monthly outgo was $914. On September 25, 2013, it was $801, a saving of $113 or Rs. 7085 each month.

Ramesh had a home loan in India for a real estate investment that he had made, for which he was paying a Rs. 50,000 equal monthly installment, or EMI. On January 1, 2013, his monthly outgo was $914. On September 25, 2013, it was $801, a saving of $113 or Rs. 7085 each month. Similarly when he sent money back home, he was getting a little more than Rs. 54,000 for every $1000 on January 1, 2013 and more than Rs. 62,000 for every $1000 on September 25, 2013.

Similarly when he sent money back home, he was getting a little more than Rs. 54,000 for every $1000 on January 1, 2013 and more than Rs. 62,000 for every $1000 on September 25, 2013.

Interest rates on both fixed income investments and loans had started to move up, as a result of measures taken to protect the falling rupee. Since the loan that Ramesh had was much lower than his investment portfolio, the net gain due to rising interest rates meant that he benefited more from the rise in interest rates, than the increase in interest cost on his loan.

The not so good news

The increase in interest rates meant that growth in India, that had already fallen sharply over the last few quarters, was likely to continue to be significantly lower than ideal. This meant that salary increases, and bonuses were likely to be sharply lower due to a combination of a slowdown in demand and cost increases due to the falling rupee. There was, therefore, unlikely to be a great degree of flexibility for compensation to be negotiated in this environment.

The equity portfolio that Ramesh had, along with his stock options, were now worth much lesser due to the slowdown in the economy. With investments in the economy at a low due to uncertainty of an election outcome and higher interest rates, these could continue to remain depressed for a while.

His real estate investment had actually started falling in value gradually, though it was still significantly higher than the amount that he had invested. With a slowdown in compensation and job losses likely in the economy, real estate prices could continue to head downwards, as the demand supply mismatch needed to correct.

Essentially, as Ramesh and Pallavi thought about all of this, they realized that the fall in the rupee was neither all great news nor all terrible news. It was actually a bit of both – as most things in life normally are – Kuch Khatta Kuch Meetha.