Market Mantra – February 2014.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

As India gets into election mode, politics in India took centrestage. February 2014 saw the resignation of Delhi Chief Minister, Arvind Kejriwal, for potentially bigger stakes. The brief tenor of the Arvind Kejriwal government in Delhi was like an Indian Premier League (IPL) tournament, which started at the end of December 2013 and ended in mid-February 2014. Just a few weeks ago, the media was all praise for the Aam Aadmi Party (AAP), Arvind Kejriwal and most people associated with it. Alas, the AAP is the favourite with the media no more though. Whilst the electorate will finally decide on who they wish to elect with young voters likely to play a key role, it does seem at this point that the NDA led by the BJP will emerge strong enough to form a government. We are hopeful that the AAP and its strong anti corruption platform will gradually result in cleaner and more efficient governance.

The effects of “taper talk” are still trickling through the emerging markets (EM) world, making them very attractive vis a vis relative valuations in the past.

Domestic Equities: February 2014 saw the BSE SENSEX move down approximately 0.87%, whilst the mid cap index is down approximately 4.46%.

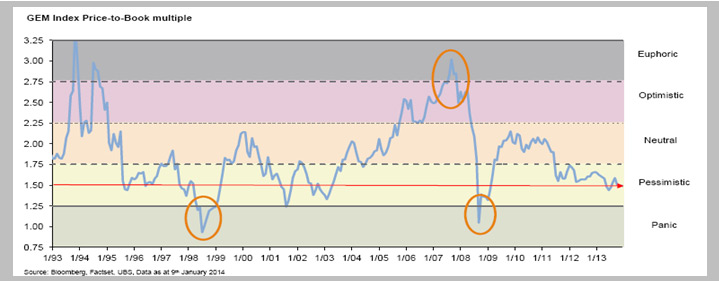

Given concerns around the impact of pulling the QE safety net from global stock markets by the Fed, and its resultant impact on emerging markets, the effects

of “taper talk” are still trickling through to the

emerging markets (EM) world, making them very attractive vis a vis relative valuations in the past. On a price to book basis, emerging markets are cheap currently by historical standards (refer chart),

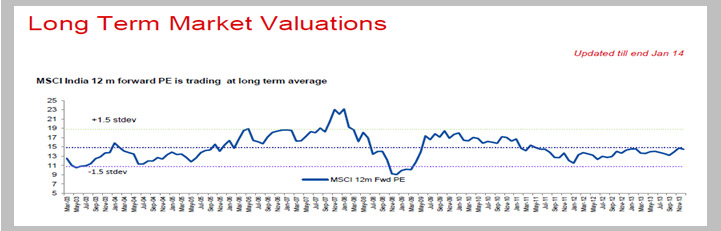

India is also trading at valuations which are in line with long term averages (refer chart)

Source: Bloomberg, Reliance Mutual Funds.

We need to remember that the rest of the world i.e. Europe and Japan continue to infuse liquidity into the system, and even though the US Federal Reserve reduced its monthly fiscal stimulus by another USD 10 billion to USD 65 billion per month from February 2014, balance sheet growth is likely to continue in 2014, providing support to global equity markets.

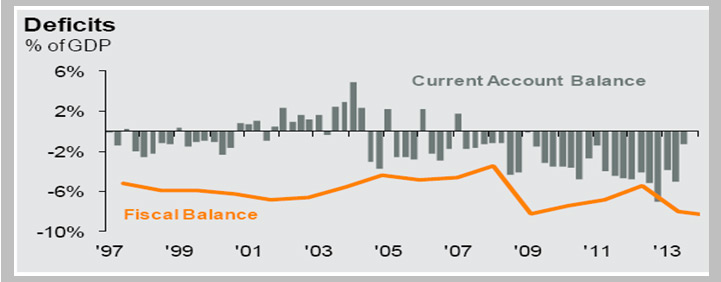

The measures taken by the UPA government and the current RBI Governor Raghuram Rajan, have stabilized the Indian Economy. As a result, the current account deficit, one of the biggest reasons for the sharp fall in the Indian rupee last year, has declined significantly as is evident from the chart.

Source: Ministry of Statistics and Programme Implementation, Office of the Economic Adviser -Ministry of Commerce and Industry, Bloomberg,

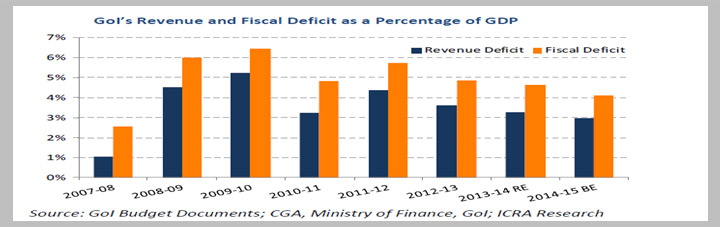

Fixed Income: The recently concluded interim budget by finance minister P Chidambaram, put the fiscal deficit for 2013-14 at 4.6% of GDP, beating his target of 4.8%, and projected next year’s deficit at 4.1%, again beating earlier projections of 4.2%. The objective was to convince rating agencies that India is on the path of fiscal virtue, and so should not suffer a credit downgrade (which would be terrible for the rupee and for markets). Whilst the mathematics around some of the projections have been questioned, there has been a significant effort made in this direction in the last few quarters of the tenor of this government, and the benefits should start to show up in the latter part of this year.

Wholesale inflation dropped to an eight month low in January due to an unexpectedly sharp decline in vegetable rates. Inflation based on the Wholesale Price Index (WPI) declined to 5.05 per cent in January 2014 from 6.16 per cent in December 2013. Consumer Price Inflation (CPI), which now gets more attention because the Reserve Bank of India has put it at the centre of its monetary policy focus, dropped to 8.79 per cent in January 2014 from 9.87 per cent in December 2013. RBI will be looking more at CPI than WPI numbers, which have been declining, but it’s still not below the 8 per cent target for the year.

The drop in headline inflation has, however, not enthused all economists because of a rise in core inflation, a measure of demand closely tracked by the Reserve Bank of India (RBI). It rose 3 per cent in January 2014, the most since April 2013 from 2.8 per cent in December 2013.

Thus, one should expect interest rates to continue to remain elevated, at least in this quarter wherein demand for money tends to be very strong because of year end pressures.

Gold: Whilst gold has been one of the best performing asset classes of 2014 so far, up 4.99 % this year in rupee terms and up 10.42% this year in USD terms, the reduction in the current account deficit could prompt the government to reduce some of the measures they took last year like import duty hikes, causing domestic prices to correct. Investors need to be ready for a correction in price due to the reduction in these duties, which could begin sooner than expected.

Asset allocation will need to be the key and investors should ensure that their exposure to gold in the portfolio does not exceed 10%.

China: A correction in the Chinese yuan over the last few days has caused concern around unwinding of multiple derivative positions that were built around the one way expectation on the Chinese currency that the Yuan can only appreciate against the US dollar. History has shown us time and again that expectations built around a singular predictable outcome tend to be very risky, and thus developments in China will need to be watched closely. As Warren Buffett once remarked –“when you combine ignorance and leverage, you get some pretty interesting results.”