Market Mantra – November 2014.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

Indian Equity markets once again touched all time highs by crossing the 28500 level on the BSE SENSEX due to various reasons like structural reforms made by strong government, weak commodity and oil prices, inflation easing further, improvement in macros and continued foreign flows on the back of strong liquidity conditions overseas

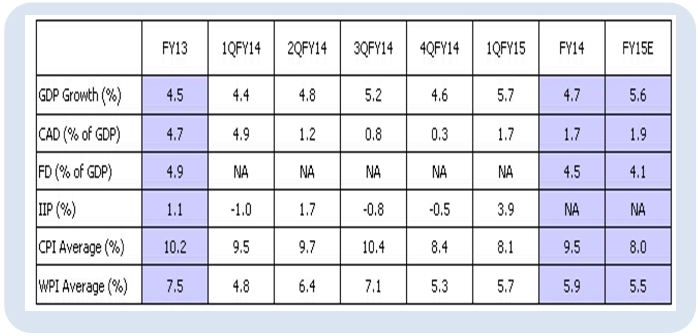

Equities:Equities: The CNX Nifty and CNX Midcap increased by approx. 6% in the last one month. The local market sentiment has remained buoyant through the last few quarters as the market anticipates a strong domestic recovery and lower interest rates in an improving policy environment. Various macro factors like GDP growth, Current Account Deficit (CAD), Fiscal deficit (FD), IIP, WPI and CPI are showing an encouraging trend in FY 2014-15, compared to last year FY 2013.

Source: Citi Research, HDFC MF, Colored rows refer to yearly data; other represent quarterly data

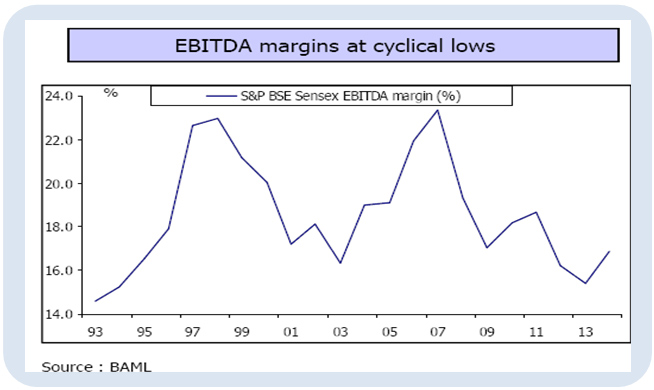

Corporate margins are currently at cyclical lows, and though earnings are still to significantly pick up and may take a few more quarters, better managed companies are starting to show some traction. As corporate margins normalize from depressed levels and as interest rates move lower, current P/Es that look expensive could start to look much more justifiable.

However, it is critical to have a long term horizon for investors buying into equities as always, as there could be volatility in the short term, especially with a consensus positive view on India. A consensus positive view tends to be a good contrarian indicator very often, so having a long term view and holding some cash to buy on corrections could be a good idea.

Source: BAML

While the U.S. continues to normalize its monetary policies, the same does not apply elsewhere. To overcome weakness in Europe, China and Japan, the respective central banks are taking steps towards more monetary easing to stimulate growth in their economies.

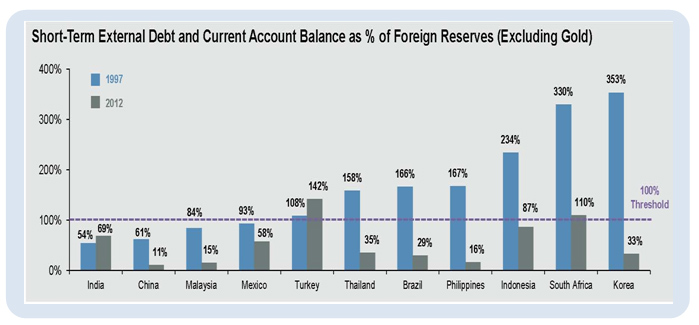

Emerging Markets like India and China have adopted a more flexible exchange rate system, increased Foreign Exchange reserves and managed their external debt in an efficient way thus far.

Source: MSCI, Credit Suisse, I/B/E/S, FactSet, J.P. Morgan Economics, J.P. Morgan Asset Management “Guide to the Markets – Asia.”

Investors should remain disciplined in maintaining a well-diversified portfolio by investing across domestic and international equities. A global economic recovery should favour equities, especially emerging markets like India and China that are likely to benefit from a global recovery. Both emerging markets and developed markets should benefit as a result.

Over the long term, the INR should continue to depreciate vs. the USD at nearly the rate of inflation differential between India and US (last 30 years CAGR of INR depreciation vs USD is 5.5 %; inflation differential between India and US is 4.8%). Therefore, we continue to recommend building international exposure in the portfolio for the purpose of diversification and act as a hedge against currency risk.

Fixed Income: While the equity market is on a high, there are good investment opportunities that we foresee in the fixed income market. There are various factors that impact inflation and the table below shows that they are moderating:

| Past | Future |

|---|---|

| High commodity prices | Lower/Stable Commodity prices |

| Strong Consumer demand | Slowdown in Consumer demand< |

| High increase in MSPs | Low growth in MSPs |

| Sharply rising diesel/petrol prices | Stable diesel/petrol prices |

Investors should start looking at bonds and bond funds (a combination of short, medium and long term options would be recommended, depending upon investment objectives and risk appetite) as a means of hedging their future reinvestment risks.

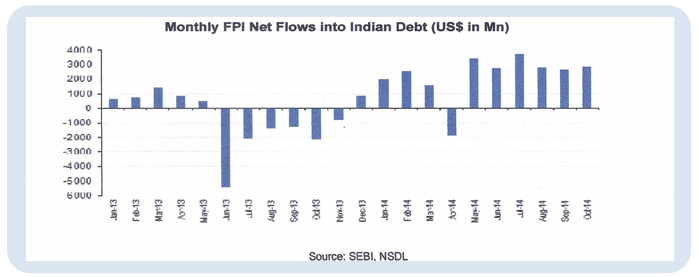

Globally the gap between US &Indian interest rates is currently high, yet, a sharper than expected reversal in US interest rates could lead to volatility / challenges for the Indian fixed income markets as well. Foreign portfolio flows into debt have also been at a high for many months now, as can be seen from the graph below, and thus investors need to be cautious about any reversal in fund flows. Thus maintaining a long term view on fixed income investments (18-36 months) would also be crucial.

Source: SEBI, NSDL

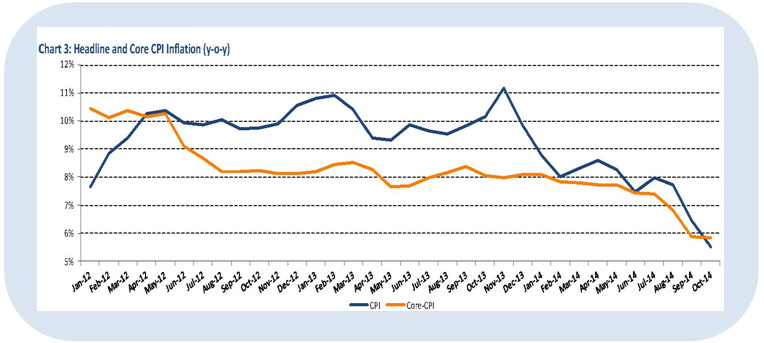

CPI inflation eased to a series-low 5.5% in October 2014 from 6.5% in September 2014 in year-on-year (y-o-y) terms. This primarily reflected a sharp decline in food inflation to 5.8% in October 2014 from 7.6% in September 2014, even as core inflation was unchanged at 5.9%.

Source: CSLO, ICRA Research

However, RBI may not cut the rates in the upcoming monetary policy in December unless they are very sure of achieving CPI inflation target of 6% by January’2016. In addition, it may want to reward investors with continued positive real returns of between 1%-1.5% p.a. over and above inflation, which should help monies move from physical assets like real estate and gold to fixed income instruments as well.

Gold: Gold may continue to see downward pressure globally, with weak commodity prices, and less fear amongst global investors. The government has removed gold import restrictions in spite of the fact that gold imports went up significantly in the last festive month to $3.75 billion. Hence, allocating only a small portion of your investments into this asset class continues to be a good strategy in our view.

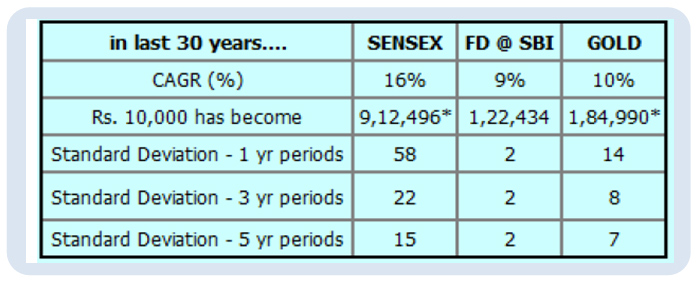

We came across a very interesting table recently showing the returns on CAGR basis and the risk measured by standard deviation over 1, 3 and 5 years holding periods of the BSE SENSEX, 1 year SBI Fixed deposit (FD) and Gold in INR terms for the last 30 years:

Source: Bloomberg, HDFC MF.

As you can see from the above data that:

FDs vs Gold: Fixed deposit returns are very close to the Gold returns in the last 30 years; however the volatility or risk in gold is much higher compared to the risk in FD. Hence, Gold is not a superior option compared to FDs to invest in from a risk perspective.

Equities vs Gold: Long term returns on equities are much higher than returns on gold (appreciation in Sensex was 5x of gold*). Volatility of equity returns is high but to a lesser extent (3x over 3 year holding periods and 2x over 5 year holding periods). Equities are therefore a superior asset class compared to gold for long term investments and for those with tolerance to volatility.