Market Mantra – July 2013.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

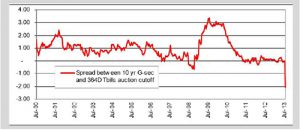

July was a month filled with action. With most emerging market currencies continuing their journey downward and the US dollar going from strength to strength, it was time for central bankers in multiple emerging markets to quickly open their textbooks. What followed was what looked like coordinated action across emerging markets to raise interest rates or tighten liquidity – China, Turkey, Indonesia, Brazil all did the same thing. India also followed in the same footsteps, with tightening actions that were similar to what had happened in the 1998 Asian crisis, the tech boom of 2000, the global financial crisis of 2008 and the aftermath of the US debt downgrade in 2011-12. This unexpected action of tightening liquidity, through measures that looked temporary, had an impact of raising interest rates sharply. Thus, we are now at a point wherein the yield curve is inverted with shorter term rates that are higher than longer term rates in the economy. In fact, the inversion between the 364 day T Bill as on July 24 and 10 year G-secs is the highest in the last 13 years.

Source: Bloomberg

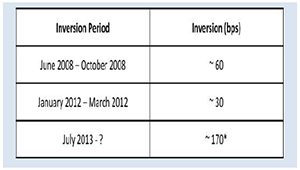

Historically, inverted yield curves do not last very long ranging from 3-6 months in the past few years

Source: Bloomberg

Considering that bond markets, due to their institutional nature, tend to react to news very quickly, we would believe that whilst there will be volatility, these are excellent times for investors to build their fixed income exposure at high rates once again. Since longer term bonds may exhibit higher volatility, investors need to be comfortable with that if they are looking to buy longer term bonds, else shorter term bonds and short term bond funds/accrual strategies should suit them better.

High interest rates may not be good news for equities though, with the only comforting factor behind that valuations continue to be reasonable, from both a price to book and price to earnings perspective. With forward earnings in the region of 1.3 to 14 times currently, we think that there is great merit in investors looking at what has happened in the past, when markets have been in these valuation zones. Investors buying into these valuation levels have in the past been rewarded with significant returns over the next 3-5 years. While a cynic would say that investors in the last 3-5 years have not made money in equities, one needs to remember that valuations 5 years ago were closer to 20 times forward earnings, and therefore the advantage of investing in a low Price to Earnings environment did not exist at that stage.

With forward earnings in the region of 1.3 to 14 times currently, we think that there is great merit in investors looking at what has happened in the past, when markets have been in these valuation zones. Investors buying into these valuation levels have in the past been rewarded with significant returns over the next 3-5 years.

A significant portion of the deterioration on the current account deficit has been on account of higher gold imports. With 1 year returns on gold now being negative and 2 years returns being in line or lower than bank deposits, we believe that it is only a question of time before investors start to question the future prospects of gold. We believe this is very common as most investors tend to look at returns from a rear view perspective, and just as they are uncomfortable with buying equities, because of its poor performance in the last few years, this is likely to start showing up with their gold purchases slowing down as

well. Lower demand for gold should be good news for India’s current account deficit and currency. Higher oil prices would be our biggest risk factor though, and with NYMEX and Brent Crude prices converging, which has historically been an indicator of higher oil prices, one would worry about that more than anything else if you were looking at equities in India.

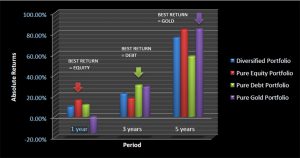

The merits of running a diversified portfolio and a clearly defined asset allocation strategy is well established from historical perspective, and we believe that investors will be well served by sticking to a well defined asset allocation strategy. We compared returns from individual asset classes i.e. Gold, Equity and Debt starting from 1st April 2007 till 26thJuly,2013 against a hypothetical diversified portfolio being a mix of 60% in Equities, 30% in Debt and 10% in Gold. We observed that returns (absolute) from the Gold portfolio were best on a 5 year basis, returns from Debt were best on a 3 year basis and returns from Equity were best on 1 year basis. Whilst it would be wonderful to predict which would be the best asset class in terms of returns for the next 1, 3 and 5 years, we do believe that these are very challenging due to multiple variables both domestic and international impacting asset class returns constantly. Therefore, we believe that it is advisable to construct diversified portfolios from both a return and risk management perspective.

| Best Returning Asset Class | Best Returning Asset Class | ||

|---|---|---|---|

| Last 1 year | Equity | Next 1 year | ? |

| Last 3 year | Debt | Next 3 year | ? |

| Last 5 year | Gold | Next 5 year | ? |