Market Mantra – June 2013.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

The domestic economic environment in India continues to be a mixed bag. With May WPI inflation being recorded at 4.70% against previous month’s 4.89%, positive expectations were built up of a rate cut in June once again. Also, the fiscal deficit continued to show a government that has shown considerable restraint on the expenditure side, with finance minister P.Chidambaram managing to tame fiscal deficit at 4.9% for FY12 – 13 as opposed to the expected 5.2% figure presented during the budget.

Good news also came in with the Indian economy’s rating upgrade from negative to stable by Fitch. The agency stated, “The

revision of the Outlook to Stable reflects the measures taken by the government to contain the budget deficit, including the commitments made in the FY’14 budget, as well as some, albeit limited, progress in addressing some of the structural impediments to investment and economic growth.”

On the shadowy side, a high current account deficit continued to be a cause for concern. With gold continuing to be a large cause of this deficit, steps were taken to curb the excessive demand of gold by raising import duty on gold to 8% from 6%. Further RBI restricted banks and NBFCs from providing loan against gold coins as well as units of Gold ETFs and Mutual Funds.

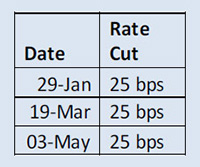

The first week of May saw a third consecutive policy rate cut of 25 bps by the Reserve Bank of India.

Whilst there continue to be expectations of rate cuts in the economy, we believe that data points with contrarian indicators will make it hard for this interest rate reduction process to be a secular process, and investors will need to be ready for a start pause process during this interest rate cut cycle.

The 10 year GOI bond yield fell to 7.44% during May as opposed to 7.73% in April. The government also launched 2023 10 year Benchmark bond at 7.16%.

Even though markets remained volatile throughout the month of May, at the end of the month, none of the popular indices seem to end farther from where they started. The news of depreciation in the rupee did cause a stir in the financial markets though,

as the correlation between the Indian Rupee and the BSE SENSEX has been very high in the past. While the Rupee kept on depreciating, various steps were taken to prevent the Rupee from falling like selling of dollars by state owned banks and increase in restrictions on gold imports.

A few more can be expected soon such as raising the FDI caps in areas like defence and telecom to bring about greater inflow of money. However, we will need to remember that this weakness in the Rupee has a combination of factors driving it, including some significant US dollar strength against most emerging market currencies brought about by expectations of a slowdown in Quantitative Easing by the Fed and the resultant increase in US bond yields.

Most Indian investors have traditionally been averse to buying assets overseas, due to a home bias and the belief that international exposure is more appropriate for large portfolios and comes with little benefit for a high growth and high interest rate environment like India.

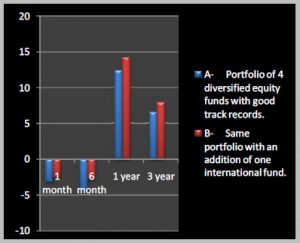

We used a hypothetical portfolio of four domestic funds with good track records, and compared the performance of this portfolio with the addition of an international fund.

We did this over a period of 1 month, 6 months, 1 year and 3 years , and find that the average portfolio with a blend of international exposure built in was able to perform better on both the upside and downside, building the case further for investors to use a combination of domestic and international exposure in their portfolio.

Gold has seen a steep fall in the recent past. This never seen before aberration led to significant purchases of Gold in portfolios locally. Including an asset in one’s portfolio is not really a function of the price of that asset but of the actual and ideal weightage of that asset in one’s portfolio. This weightage varies from portfolio to portfolio basis multiple factors including risk profile, financial goals, etc. Thus, it is crucial to look at the decision of increasing / decreasing exposure in an asset basis the overall portfolio mix, rather than basis a sharp increase or decrease in its price.

Whilst there are both opportunities and risks in financial markets at this point in time, I cannot help but quote George Horace Lorimer, a well known American journalist and author.“ Its good to have money and the things that money can buy but its good, too, to check up once in a while and make sure that you haven’t lost the things that money can’t buy. “