Market Mantra – August 2013.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

This month saw RBIs back pedalling action. In the month of July, RBI had announced liquidity tightening measures to prevent the incessant fall in the Rupee. However, these measures seemed to follow the ‘principle of double effect’ ie while trying to control the fall of rupee the short term and long term interest rates were affected too. Equity markets also faced a downturn and entered the 17000s this month. However, currency continued its journey towards 68. In order to avoid hardening long term rates, RBI has recently announced a bond buy back program.

This time the RBI has to address the Trilemma famously termed as “The impossible trinity” of:

- Control the free-fall of INR – The currency has depreciated 10% against the Dollar year-to-date. This depreciation results in a higher current account deficit, forex reserves are strained and also fuels inflation.

- Curbing Inflation–Inflation is not a new member in the RBIs family of problems. WPI now is in levels of 5-6% but this may be affected by depreciation of Rupee.

- Fuelling Growth – The growth forecasts are now showing a significant slowdown.

The increase in crude oil prices have actually added fuel to the fire. As India imports 80% of its Oil requirements which would directly worsen the Current Account Deficit.

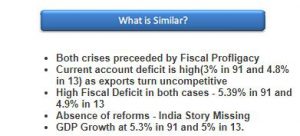

Questions are being raised on whether the 1991 Balance of Payment crises would be repeated looking towards depreciating rupee and trade gaps. Let’s see in what ways are the two similar and different:

Source: Times of India.

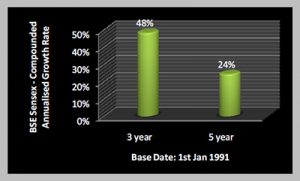

Similarities between 1991 crises and now are high current account and fiscal deficits, and low GDP growth. There are differences too (as in the exhibit) which clearly shows that the situation is better now. No two situations are exactly same. We hold that every dark cloud has a silver lining. Similarly, every downfall brings future opportunities. We did an analysis to check the returns from BSE Sensex over 3 year and 5 year period to see how the numbers after the crises looked

.

We need to remember the above period was also the period in which the Harshad Mehta scam happened, so not all data can be viewed in isolation.

As a confluence of international and domestic factors rear their head, we do believe that investors will need to brace themselves for some tough times and measures. It is not a time for bravado but for some level headed decisions around a robust asset allocation strategy and diversification across instruments and geographies.

History may or may not repeat itself but the times of crises bring about both corrections and opportunities.