Market Mantra – May 2014.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

With most opinion polls and exit polls predicting a scenario for the BJP led National Democratic Alliance (NDA) wherein they would fall short of a majority by themselves or just about be able to cobble together a majority, the final numbers that came in were definitely a surprise, with the BJP winning an absolute majority all by itself, the NDA getting a significant number over the numbers required for a majority, and the Congress being reduced to the equivalent of a regional party.

The large margin of the victory means that the balancing act that most coalition governments have had to manage in the past to keep multiple constituents of the coalition happy, is not going to be a challenge for the new government. The other heartening fact was that the election was won on a development and growth plan which is an endorsement of the fact that the young India voted on issues that are very different from the past. In fact, this voting pattern on the plank of development is a continuation of similar behavior in multiple state elections in the last few years, and is certainly a trend to watch out for, creating more accountability on the political class and is potentially something which could be a game changer as governments, both at a central and state level, focus on economic issues far more than they did in the past.

The financial markets also seemed to be excited by the fact of India getting ‘Modi’fied as it is commonly termed.

On the day of the election result, the SENSEX temporarily crossed the 25000 level. Thus over the last month, the SENSEX and midcap indices have risen 7% and 11.2% respectively.

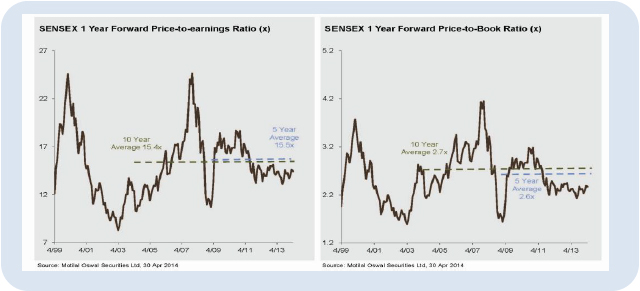

In spite of the fact that indices are at an all time high, the forward valuations are reasonable, with both Price Earnings ratios and Price to Book Ratios being below averages.

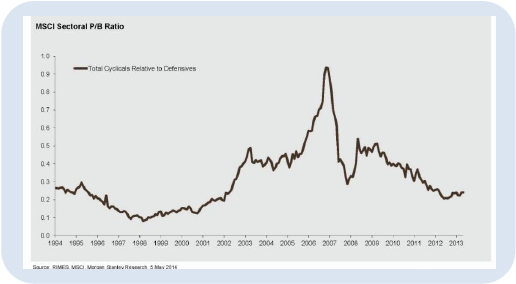

Cyclicals also continue to be at significant discounts (Price to book). Refer Graph.

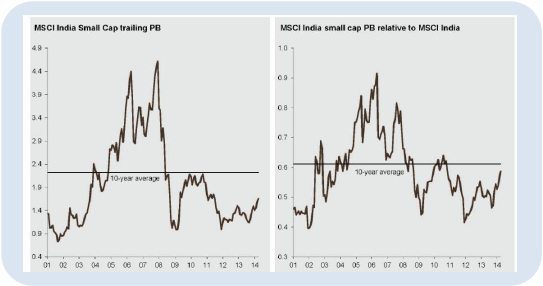

Small cap and midcap are also significantly at discount to the fair value vis a vis the 10 year average (refer to the graphs below):

With the expected impetus of the new government to focus on the revival of the investment cycle and infrastructure creation, the challenge for the new government will be to set realistic expectations on when the turnaround can actually materialize, and not get drawn into the dangerous game of sacrificing what is good for the economy longer term at the altar of short term gains.

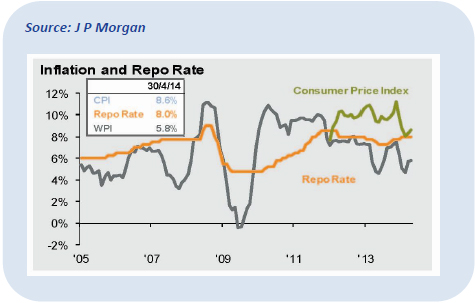

The choice of the Finance Minister and the role of the RBI governor in balancing the growth vs inflation dynamics is likely to be crucial moving forward, especially with the possibility of a weaker monsoon and worries of inflationary expectations in the economy starting to build up once again.

With fiscal challenges continuing in the economy, one can expect that the budget slated in early July will provide a better perspective on how the new government looks to focus its limited resources and direct them for maximum effect. Structural reforms like the roll out of the Goods and Services Tax( GST), direct tax code changes and reduction in red tape need to get immediate attention.

The weight of managing expectations on the new government is likely to be a challenge in itself, and whilst there will possibly be a 12 to 18 month honeymoon period for the new government, one needs to remember that global factors including liquidity flows, will continue to be needed to be watched out for very closely Confucius once famously said “ The expectations of life depend upon diligence; the mechanic that would perfect his work must first sharpen his tools.”

Investors will need to focus on their strategic asset allocation so that they do not get carried away by the euphoria that tends to come with unexpected outcomes that are viewed as positive. In case portfolios are underweight equities, they will need to be added to, whilst portfolios that are already overweight equities, may need to see some rebalancing towards fixed income.

The low level of equity ownership of domestic investors is also a positive for mid and small caps as there had been a tendency historically for retail investors to build exposure to equities through mid and smaller sized companies.

With the expected impetus of the new government to focus on the revival of the investment cycle and infrastructure creation, the challenge for the new government will be to set realistic expectations on when the turnaround can actually materialize, and not get drawn into the dangerous game of sacrificing what is good for the economy longer term at the altar of short term gains.

The choice of the Finance Minister and the role of the RBI governor in balancing the growth vs inflation dynamics is likely to be crucial moving forward, especially with the possibility of a weaker monsoon and worries of inflationary expectations in the economy starting to build up once again.

With fiscal challenges continuing in the economy, one can expect that the budget slated in early July will provide a better perspective on how the new government looks to focus its limited resources and direct them for maximum effect. Structural reforms like the roll out of the Goods and Services Tax( GST), direct tax code changes and reduction in red tape need to get immediate attention.

The weight of managing expectations on the new government is likely to be a challenge in itself, and whilst there will possibly be a 12 to 18 month honeymoon period for the new government, one needs to remember that global factors including liquidity flows, will continue to be needed to be watched out for very closely Confucius once famously said “ The expectations of life depend upon diligence; the mechanic that would perfect his work must first sharpen his tools.”

Investors will need to focus on their strategic asset allocation so that they do not get carried away by the euphoria that tends to come with unexpected outcomes that are viewed as positive. In case portfolios are underweight equities, they will need to be added to, whilst portfolios that are already overweight equities, may need to see some rebalancing towards fixed income.

&Investors will also need to avoid the temptation of giving up the process of diversifying their portfolios overseas, as that continues to be a crucial risk mitigation tool on portfolios and the appreciating equity or currency markets in India should not come in the way of continuing that process that has only just begun for most investors.

Fixed Income: Even though the Equity markets are rejoicing the NDA win, debt markets still appear skeptical. The 10 year GSec yield still ranges between 8.75% and 9%, as the debt

market tries to get a better sense on government finances, and RBIs view on interest rate direction . Repo rate is also more and more dependent on Consumer Price Inflation (CPI) numbers. Therefore, if the CPI does not come down the Repo rate is unlikely to be revised downwards.

Investors in fixed income can look at enhancing exposure to longer term fixed income products like duration funds gradually, as a focussed fiscal consolidation effort by the government is likely to be looked upon by the RBI as a positive for inflation, and could be supported through monetary policy decisions that are not as aggressive as they have been in the past.

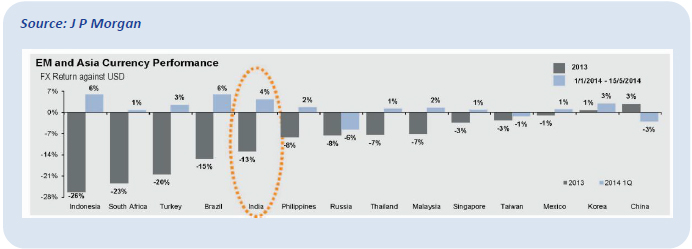

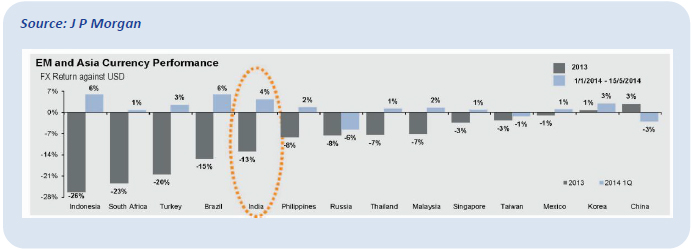

Currency: The fair value of rupee is believed to lie in the range of 58-62. RBI has been buying dollars to avoid appreciation of rupee. Inflow of foreign currency over the positive growth expectations of Indian economy could contribute to appreciation of rupee. However, one needs to keep in mind that these inflows are significantly a function of risk appetite amongst global investors and thus the Indian currency appreciation in 2014 thus far, has not been an isolated event, as you will notice in the graph showing the INR vis a vis other emerging market and Asian currencies. As long as inflation differentials of India vis a vis the US continue to be high, the currency will need to depreciate to keep the economy and exports competitive.

Gold: The outlook on Gold still remains negative and the attractive valuation of asset class like equity makes it a less attractive investment vehicle. In addition, import duty cuts and currency appreciation could continue to be challenges for gold in the shorter term.