Market Mantra – September 2013.

– Vishal Dhawan, Chief Financial Planner, Plan Ahead Wealth Advisors.

The month of September saw financial markets moving in a wide range. They started off with a lot of scepticism on the back of both global and domestic concerns, but the appointment of a new Reserve Bank of India governor, Raghuram Rajan, and a set of measures aimed at stabilising the rupee announced on his first day in office created a lot of excitement. The data from the US on the Fed tightening, as well as the news from Syria about slowing down of military action by the US on the back of intervention from Russia, which helped in bringing oil prices down, all combined together to create a significant upward move in both financial markets and the Indian Rupee. The delay in the much awaited Fed tapering program in the US, also caused a huge rally in financial markets post its announcement.

RBI has gradually begun to roll back some of the measures taken in response to the fall in the rupee, targeted at reducing the highly elevated short term rates in the system. This is probably an indicator that they believe that the Indian Rupee volatility may reduce moving forward.

This euphoria, though, was shortlived, as the RBI governor quickly got down to focussing on key issues that are currently creating a challenge for the Indian economy – namely taming inflation and inflationary expectations. In the policy review announced just the day after the Fed announcement of a delay in its tapering program, RBI raising repo rate by 25 bps to signal that inflation continues to be the biggest challenge in the economy. At the same time, RBI has gradually begun to roll back some of the measures taken in response to the fall in the rupee, targeted at reducing the highly elevated short term rates in the system. This is probably an indicator that they believe that the Indian Rupee volatility may reduce moving forward.

Fixed income opportunities

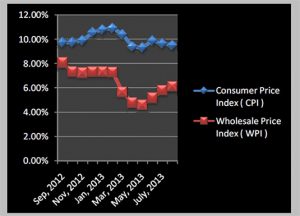

Considering the focus on inflation, protecting purchasing power during inflationary periods will be key for portfolios moving forward. This is even more important as there is a wide gap in India between the Wholesale Price Index (last reported at 6.1%) and the Consumer Price Index (last reported at 9.5%) (Refer graph). Traditionally, products that are linked to inflation tend to be good tools in this environment. Whilst the options in this space are currently limited, the announcement of introducing inflation indexed bonds linked to the CPI should be a good option for investors to consider. Expect an announcement on these in October/ November. In addition, tax free bonds that are offering very attractive coupons currently for long tenors, are excellent options to lock into long term yields, as the pre tax coupon on these bonds are in the range of 11.5%pa to 12.5%pa for investors in the highest tax bracket.

Investors unwilling to lock in for such long durations, and having a 1- 3 year view, should look at investing in short duration bonds such as accrual oriented mutual funds. Current yields on the shorter end are elevated and with RBI likely to continue to roll back measures that moved short term rates up, investors can potentially look at attractive returns from this category. It is crucial to focus on credit quality of the bond and bond portfolios though, as this is not an environment to take undue credit risk to enhance portfolio returns.

Indian Rupee

The free fall of the Rupee came to a pause due to the Fed’s decision to continue with its asset purchase programme. The government has also curbed gold imports through multiple measures including duty hikes. This should result in a lowering of the current account deficit, which should bode well for the Indian Rupee as well. However, with inflation differentials between India and the US likely to continue to be significant moving forward and the fiscal and current account deficits being watched by global investors and rating agencies very closely, the Indian Rupee is unlikely to see any further appreciation

Equity portfolios

Rupee depreciation can hurt companies which have taken foreign currency loans and import raw material. Therefore, equity investors should avoid companies with large debt, whether foreign or domestic, as interest rates and currency movements may not be good for these businesses. Export oriented businesses and sectors, could benefit from the rupee correction and broad recovery in global markets. With the postponement of the Fed tapering program, expect to see volatility in equities each time there is a Fed meeting till there is more clarity on the tapering program.

Rupee depreciation can hurt companies which have taken foreign currency loans and import raw material. Therefore, equity investors should avoid companies with large debt, whether foreign or domestic, as interest rates and currency movements may not be good for these businesses.

Investment in global funds can help you limit losses when the rupee is falling, as well as diversify your portfolio beyond the risks in domestic markets. Investors need to look at this category closely, and take advantage of the increasing range of solutions now being made available to Indian investors.

Manage Debt.

As interest rates are expected to rise further to respond to rate increase measures by the RBI to curb inflation, existing borrowers could see a spike in Equated Monthly Instalments (EMIs ) on their loans. The default option that banks exercise is an increase in the tenure of the loan, especially in the case of home loans where most loans are now floating and linked to the base rate. The EMI will typically remain the same, but the tenor of you loan will increase. Therefore you would feel no pinch on your pocket today, but the effective interest paid on your loan will increase. You could go on with your life as if nothing has happened, or look to wither prepay your loan or increase the EMI.

You would understand the benefit of interest saved on your loan by increasing your EMI from the table:

| Current Stuation (Interest Rate : 10% p.a.) | ||||

|---|---|---|---|---|

| Loan Amount (Rs.) | Interest Rate | Tenure (months) | EMI (Rs.) | Total Repayment Amount(Rs.) |

| 1,00,00,000 | 10% | 180 | 1,07,460 | 1,93,42,892 |

| New Situation (Interest Rate increased to 11% p.a.) | ||||

| Option 1 : If EMI is kept Constant & Tenure is Increased | ||||

| Loan Amount (Rs.) | Interest Rate | Tenure (months) | EMI (Rs.) | Total Repayment Amount(Rs.) |

| 1,00,00,000 | 11% | 210 | 1,07,460 | 2,25,66,707 |

| Option 2 : If Tenure is kept Constant & EMI is Increased | ||||

| Loan Amount (Rs.) | Interest Rate | Tenure (months) | EMI (Rs.) | Total Repayment Amount(Rs.) |

| 1,00,00,000 | 11% | 180 | 1,13,660 | 2,04,58,745 |

| If opted for Option 2, Savings of Rs. 21,07,962 | ||||