Exit polls are just projections and may not always be representative of the actual election results. Today’s election results suggest that the Bharatiya Janata Party (BJP), in coalition with the National Democratic Alliance (NDA), is likely to form the next government though there may be other scenarios as well that could emerge over the next few days.

India has rarely seen parties winning with an absolute majority. After a gap of 30 years, the BJP won with an absolute majority in both 2014 and 2019. However, the 2024 election appears to be heading towards a coalition government.

On June 4, 2024, the Nifty 50, Nifty Midcap 100, and Nifty Small Cap 100 indices corrected by more than 5%. However, you need to keep in mind that the closing levels today on the Nifty 50 are at the same level as where they were less than a month ago ie on 10th May 2024. Additionally, India’s 10-year G-sec yield increased by 8 basis points, rising from 6.95% to 7.03%. These market movements were in response to the BJP’s inability to secure a standalone majority, which was expected by the market.

After a decade of a majority government, we are likely to witness a coalition government. The new government is expected to prioritize infrastructure spending, albeit with populist measures. The stock market performance post-year election results seem to indicate that the Sensex reacts indifferently to a strong coalition and a majority government.

In this current scenario, here are five actionable steps to consider:

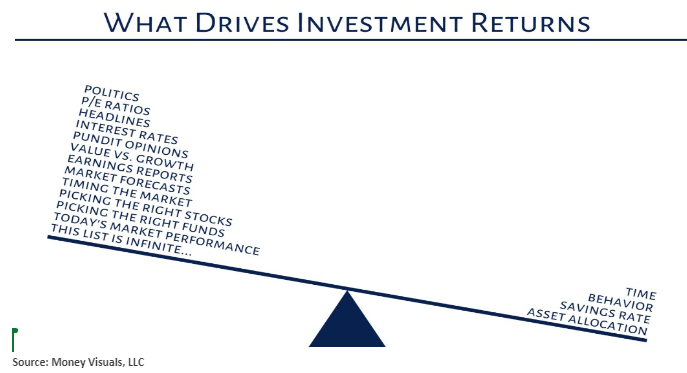

- Focus on Fundamentals: Long-term market movements are primarily driven by fundamental shifts in company earnings, rather than election outcomes. Stay focussed on that.

- Overvaluation: While markets remain expensive, the knee-jerk reaction has slightly reduced overvaluation. However, markets continue to be expensive compared to their long-term historical average. It’s prudent to favor large caps over midcaps and small caps at present.

- Seek Valuation Comfort: Expect the emergence of pockets with valuation comfort in the near to medium term. One can look to deploy excess liquidity in such pockets.

- Bond Market: Despite the recent 8-basis-point increase in India’s 10-year G-sec yield, sustained rises are unlikely. Factors such as high dividends from RBI and inclusion in the JP Morgan bond index may act as tailwinds, potentially leading to lower yields ahead. Any mark-to-market impact can be recovered as underlying papers mature. One can consider adding duration to the portfolios gradually as one could benefit from duration.

- Staying the Course: It’s essential for investors to refrain from making significant alterations to their investment strategies based solely on election results. Maintaining focus on individual financial goals remains paramount.

Disclaimers:

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The information is only for consumption by the client and such material should not be redistributed.

The securities quoted are for illustration only and are not recommendatory.