While thinking about investing an investor may think about taking inspiration from the great investment gurus such as Ben Graham, Peter Lynch, Warren Buffett, and John Bogle amongst others. These legendary investors had their own opinions and approaches to investing, some believed in active investments whereas some in passive investments.

Before we delve into this blog on “Should passive investments be a part of your portfolio?” let us understand some financial jargons about active and passive investments. A passive mutual fund scheme or ETF replicates the index that it tracks. This means that if you buy a Nifty 50 Index fund or Nifty 50 ETF, such a fund will invest in the Nifty 50 stocks in the same proportionate as of the actual Nifty 50 index. No active decisions to increase weightage or stocks, or to reduce weightage or stocks, will be taken by the fund manager. In comparison, in an active mutual fund scheme, if the fund manager is bullish or bearish on a particular stock or segment he can go overweight or underweight, or may include or exclude stocks from the mandated universe of stocks. The intention in an active scheme here would be to generate returns in excess of the benchmark by active management of the scheme portfolio.

In 2008, Warren Buffett had wagered a million-dollar bet with hedge fund managers that the performance of their funds doesn’t justify the high fees charged. Protégé Partners, a hedge fund manager, had accepted that bet. Warren Buffet had contested that in over 10 years, an S&P 500 index fund, adjusted for fees, would beat the performance of an active fund manager. Warren Buffet won the bet handsomely. As Protégé co-founder Ted Seides conceded defeat in 2015, ahead of the scheduled wrap-up, he wrote “the game is over, I lost”. This was a great example of active being pitted against passive investing.

Peter Lynch who is known for his renowned stock picking skills managed the Fidelity’s Magellan for 13 years from 1977 to 1990, during which the fund generated a CAGR of 29% beating the S&P500 in 11 out of those 13 years. Peter Lynch once stated, “This move to passive is a mistake, People are missing the boat.” This displayed his strong opinion about active investing.

We hope with this background we have set the right tempo for an interesting read. Let us now look at some data with an Indian lens on whether you are missing the boat.

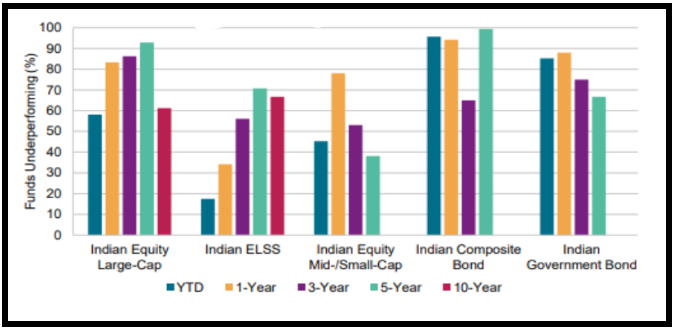

The latest data from S&P Indices versus Active report (SPIVA) mid-year 2023, makes the decision-making pretty obvious when it comes to large-cap mutual funds.

From the graph and tables below, we can see that over a 5 year time horizon, over 90% of Indian equity large-cap funds have underperformed their benchmarks which is the S&P BSE 100.

From the graph and tables below, we can see that over a 5 year time horizon, over 90% of Indian equity large-cap funds have underperformed their benchmarks which is the S&P BSE 100.

Source: SPIVA Mid-year 2023. The securities quoted are for illustration only and are not recommendatory.

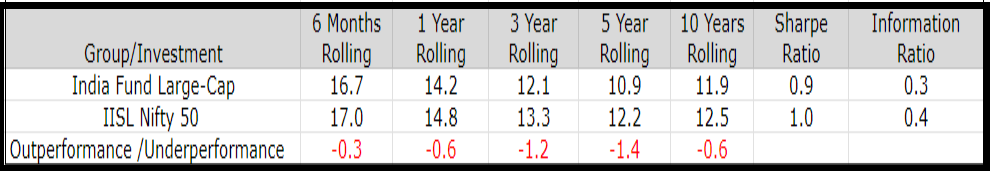

*Source: MorningStar. The securities quoted are for illustration only and are not recommendatory.

A part of the large cap underperformance can be linked to the management fees. For example, a regular large-cap mutual fund is 130 bps more expensive than a regular large-cap index fund whereas a direct large-cap mutual fund is 70 bps more expensive than a direct large-cap index fund.

In the case of India Equity Mid and Small-cap schemes, the SPIVA report data may not be that straightforward, as the SPIVA report has combined both Midcap and Small-cap and compared it to the BSE 400 instead of individually comparing the Midcap to BSE 150 midcap index and Small cap to BSE 250 small cap index.

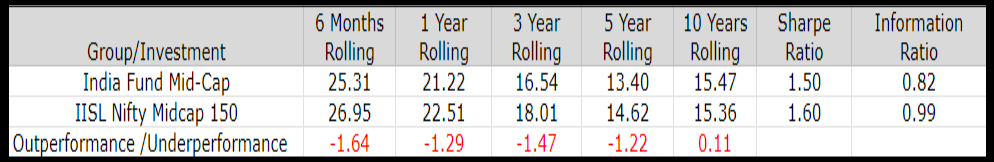

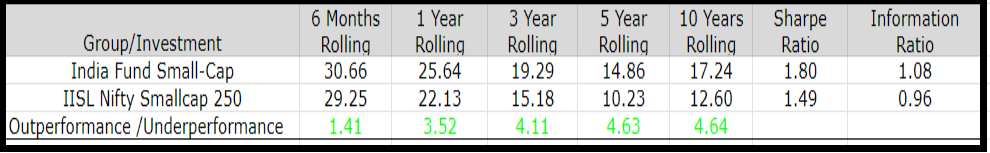

The below table compares actively managed small cap, mid cap mutual funds against respective benchmarks. When it comes mid-cap funds, returns data suggests that a passive option would be suitable as funds have consistently underperformed their benchmarks, whereas, in the small-cap funds, funds have outperformed their benchmark consistently, the data from below makes a strong contention for actively managed small-cap funds.

When we look at the small-cap sector, the fund manager would need to actively look out for accounting shenanigans, one-off items, corporate governance, and such parameters making actively managed funds a better alternative than passively managed funds small-cap funds. The below table on the small cap category supports this argument.

**Source: MorningStar.

Additional advantage of a passive index fund is that there is no element of human biases as most indexes are rebalanced semi-annually or annually, and any underperforming stock which fails to meet the criteria of selection is removed automatically, thereby eliminating human biases.

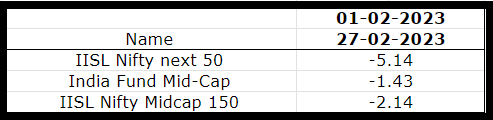

Just like all things white are not milk, there are a few drawbacks to passive investing. For example, during February 2023 when a certain index stock had an allegation related to accounting manipulation, the passives indices like the Nifty Next 50 and Midcap 150 index saw a higher correction compared to the actively managed funds. At that time very few active funds had exposure to this stock and they were largely insulated. However, the passive schemes got hurt, as these did not have a choice and were simply mirroring the index and therefore had this holding in their portfolios in the first place. The below data shows details.

***Source: MorningStar.

From the above, we can conclude that investors need to have a blend of both active and passive investments in their portfolios as both the strategies have merits in the Indian scenario. Awareness, monitoring, and tracking of investment portfolios, styles, weightages, can help an investor make prudent portfolio decisions.

Footnotes

*India Fund Large-Cap and IISL Nifty 50 TR INR are both compared on total return basis. Negative/RED refers to underperforming Actively managed funds against benchmark.

**All the data points, India funds small cap, India funds midcap, IISL Nifty Smallcap 250 TR INR and IISL Nifty Midcap 150 TR INR are generated on total return basis. Negative/RED refers to underperforming actively managed funds against benchmark where as positive/green refers to outperformance of actively managed funds against benchmark.

***All three data points IISL Nifty next 50, India Fund Mid-Cap and IISL Nifty Midcap 150 TR INR are compared on total return basis.

India Fund Small-Cap- Morningstar category average for small cap funds.

India Fund Mid-Cap-Morningstar category average for midcap cap funds.

India Fund Large-Cap-Morningstar category average for large cap funds.

Disclaimers

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The securities quoted are for illustration only and are not recommendatory.

The information is only for consumption by the client and such material should not be redistributed.