A good starting point to consider when you think about managing your money in 2024, will be to look at what happened in 2023. 2023 was clearly a year where high inflation took center stage, with central banks doing whatever it took for inflation to be brought under control through multiple interest rate hikes. Now that inflation has come down meaningfully in most parts of the globe, even though they are still above where central banks would like them to be, 2024 looks set for a pivot on interest rates. As a result, markets have shifted their focus from interest rate hikes to interest rate cuts in 2024.

Developed economies are seeing structural changes as there is a growing share of retirees. As a result, unemployment is continuing to be at historic lows. Additionally, geographical fragmentation, restoring, and rewiring of global energy systems (moving from fossil fuels to renewables) are creating their own pricing pressures for fuel, though increasing supply by non-OPEC nations have kept oil prices under control. Hence, major central banks may have to trade-off between raising interest rates thereby crippling growth, or being comfortable with inflation at higher levels than one has been used to seeing for most of the last decade.

Thus, one should not be surprised if interest rates remain higher for longer in many economies as central banks fear cutting interest rates too early, to avoid inflation going up once again. Of course, market participants expect that most developed central banks could start to cut rates in the second or third quarter of 2024.

In Emerging markets, the challenges are unique for different economies, with China facing deflation due to weak demand and real-estate concerns, whilst India gets into national elections in 2024, and a K-shaped recovery creating a significant rural-urban divide. However, in spite of these challenges, most equity markets did well in 2023, once again demonstrating the futility of trying to time entry and exit into equities excessively and taking significant cash calls. Clearly, Artificial Intelligence was a key theme that boosted the prices of the magnificent 7 in the US markets ( Tesla, Amazon, Meta, Nvidia, Google, Microsoft, and Apple).

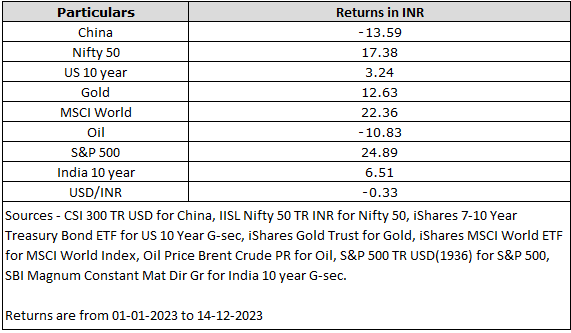

Investors would have been pleasantly surprised at the performance of most asset classes, albeit on the back of a terrible 2022 as can be seen below:

Source- Morningstar Direct

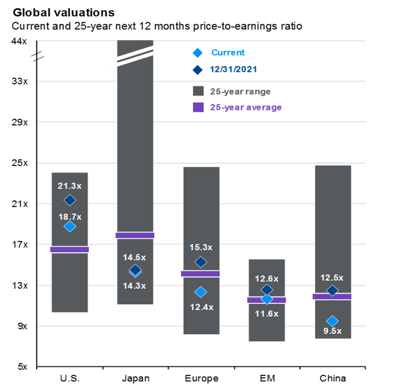

One of the challenges that investors globally will face is significantly higher than normal valuations in equity markets where they may have or want to have larger exposures, namely India and the US, as well as elections in both these geographies during the year. The Chinese markets, in contrast, are trading at a steep discount to their long-term averages, but could well be a value trap due to the poor news on the economy and political events in China.

Source – JPM Guide to Markets November 2023

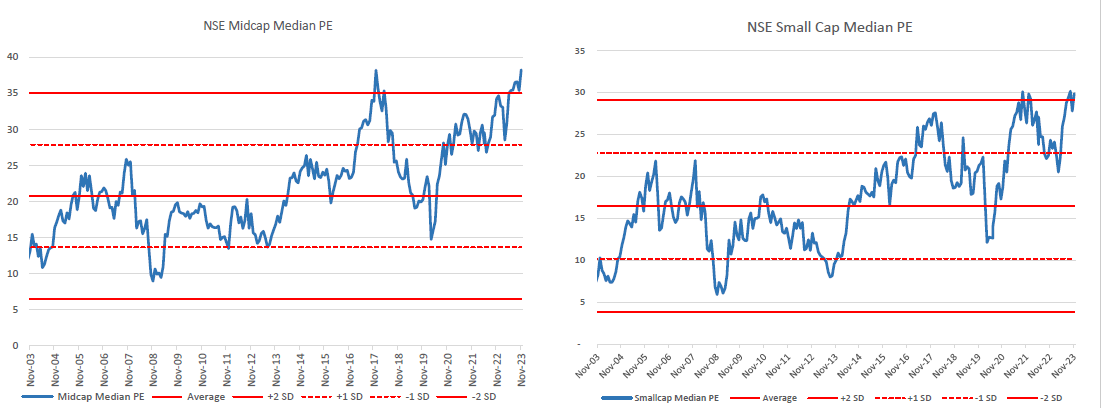

The weightage of India has doubled in the last 3 years to ~ 16% in the emerging market basket, and this has increased FII flows into the Indian markets. RBI has also raised the GDP forecast upwards by 0.5% for FY 24 indicating the economic momentum could continue. As a result, Indian markets have scaled to new highs, but the valuations of Indian markets, especially on mid and small-caps appear frothy.

Source- Multi-Act, Nov-2023

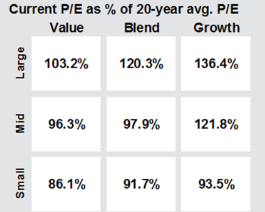

US markets, especially the large and mid-cap growth look expensive, and thus investors may wish to allocate cautiously.

Source – JPM Guide to Markets November 23, 2023

Gold has tended to be a good asset to have in times of reducing interest rates, and to protect against geo-political risks, which may well continue going forward, and thus may continue to be well supported.

Fixed income instruments could benefit from higher for longer interest rates, as well as rate cuts as and when they happen, and could therefore be a good place to allocate capital.

Real Estate demand is also seeing a pick-up in India, and could well see meaningful allocations. Alternatives like Real Estate Investment Trusts ( REITs) and Infrastructure Investment Trusts (INVITs) could also be an interesting proposition with interest rates peaking out.

2024 seems to be the year, where you may be tempted to skew towards any one asset class at different points, maybe equity, maybe real estate, or maybe the safety of fixed income. Every time that happens in 2024, control this urge and let a well-thought asset allocation strategy be your money management mantra. The more excited you feel about the future, the more the need for this asset allocation strategy.

As you make your resolutions for 2024, don’t forget the one that matters most for your finances in 2024 – asset allocation with rebalancing at regular intervals.

Standard warning: Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL, and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The securities quoted are for illustration only and are not recommendatory.

This information is only for consumption by the blog reader and such material should not be redistributed.