Business and working professionals often excel at generating substantial income, yet true financial success hinges on transforming that income into enduring wealth. Whilst a high six or seven figure salary or a lucrative bonus feels gratifying, lasting assets are what secure multigenerational prosperity.

The key parameters for translating this flow of income into a stock of wealth are as follows.

Consistent Investments with lower volatility

Consistent investments include a disciplined approach where an investor makes regular contributions to investments irrespective of market conditions. This commitment by investors greatly reduces the risk of timing the market and provides benefits from rupee-cost averaging. The impact of short-term market fluctuations is reduced in this approach as investors buy more units when markets are trending down and fewer units when they are trending up.

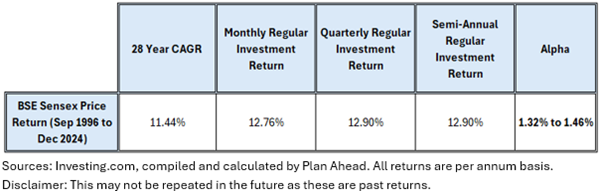

The below chart shows Rolling Returns on a monthly basis for BSE Sensex TRI for SIPs between September 1996 to December 2024

From the above chart, we can see that when the investment horizon increases, market volatility reduces as the maximum return and minimum return get closer to the median and average return of the market.

Moreover, consistent investments delivered an alpha close to 1.3% p.a to 1.5% p.a in the same period compared to a lump sum investment at the start of the period. Hence, past data analysis shows that consistent investments for a long period of time have the potential to reduce volatility and generate better returns often.

Leverage Income Streams into Diversified Income-producing Assets

Professional careers often come with opportunities that enable individuals to have different income streams. One way to use these varied income streams would be to associate each stream to a particular asset class, which helps you to actively build a diversified asset portfolio that consistently generates passive cash flow from different sources.

Certain assets and securities provide better yields than others during market turmoil, Investors can use cash flows from different sources to invest into higher quality assets with valuation comfort provided by the market turmoil and fuel their growth assets exposure .

Additionally, Investors who can see their retirement in a decade or so can divert a particular stream of income to build an asset that will provide cash flow to finance a particular set of expenses after retirement like insurance, vacation, or other valuable activities for them.

Windfall Income Buffer: A Smart Play for Long-Term Growth

Bonuses and unexpected income may feel like rewards, but in a professional career, treating them as growth capital rather than splurge money can significantly transform your financial trajectory. Earmarking a portion—say 60% of this cash flow as a buffer to invest in asset classes typically avoided due to higher risk or volatility can be a powerful strategy.

This additional income could also be received by you when there is an equity market dip – for instance, in the 1st quarter of FY22- 23, markets were down by 10 to 15% from their recent highs, after which they provided attractive returns over the next 2 years.

These scenarios provide investors with an opportunity to make lump-sum investments into high-conviction asset classes at reasonable valuations.

In conclusion, for the financially astute, these methods should help investors divert their flow of income efficiently to create wealth and provide them with a rewarding Investment journey.

Disclaimers:

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL and certification from National

Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The information is only for consumption by the client and such material should not be redistributed.

The securities quoted are for illustration only and are not recommendatory.

This material is for information and educational purposes only.