Investing in an initial public offering (IPO) can be exciting, especially when there is a lot of buzz and many IPOs are delivering strong post-listing gains in the short term. But before deciding whether to jump in, let’s look at some data points related to IPOs and Pre IPOs

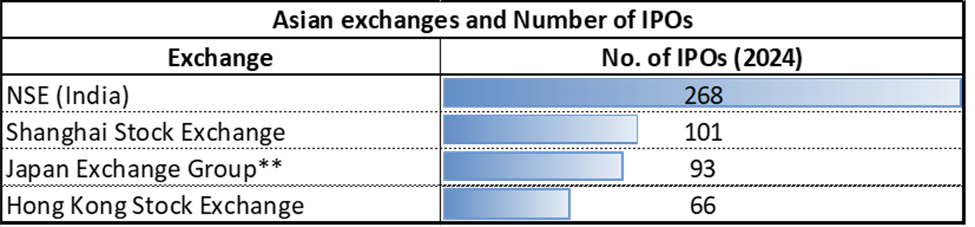

The year 2024 saw over 90 companies raising a record ₹1.62 lakh crore—more than double the ₹49,436 crore raised in 2023. The National Stock Exchange (NSE) set a new benchmark in Asia by hosting the highest number of IPOs in 2024.

**Includes SMEs **combination of six exchanges *Source: Business Standard – 3rd Jan 2025/NSE statement

Interestingly, most of an IPO’s outperformance happens on listing day. After that, it’s a challenging journey. With ample liquidity, investors often flock to avenues like IPOs in pursuit of quick returns. However, as the chart below shows, this excitement tends to fade when markets begin correcting. Weak fundamentals, overlooked in the frenzy, start to surface as IPOs lose momentum after their initial listing surge.

*Source: DSP Netra. Data as of Nov 2024. * Public fundraising includes IPOs, FPOs, and OFS. *

Pre-IPO

The demand for pre-IPO investments is also on the rise, as securing an IPO allotment has become increasingly difficult due to high competition.

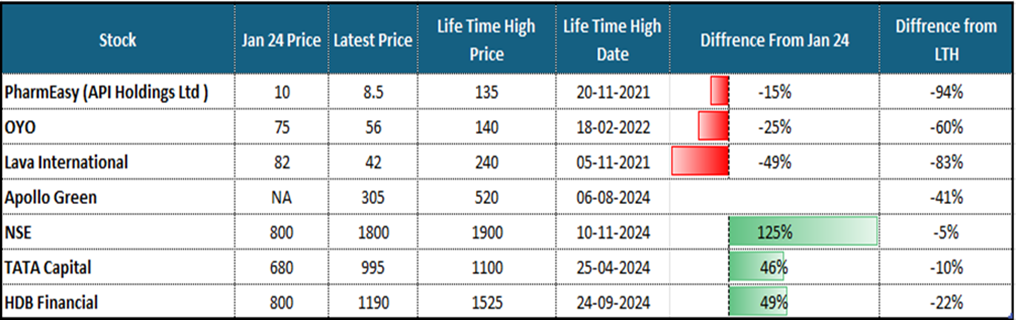

The chart below highlights the performance of buzzing unlisted stocks. Recent performance of stocks like NSE, Tata Capital, and HDB Financial have shown strong growth whereas stocks like PharmEasy, OYO, and Apollo Green have declined significantly.

*Source: wwipl.com

The sharp drops from their lifetime highs show the wealth destruction faced by investors who have bought these stocks at peak levels.

In another chart below, observe how these stocks were trading at elevated prices before their IPOs and how the sentiments changed after the listings.

*Source: wwipl.com

Therefore, it’s important to carefully evaluate a few key factors before investing in pre-IPO stocks, such as:

Uncertainty of Going Public – The biggest risk with pre-IPO investments is that the company may never go public.

Liquidity Challenges – Pre-IPO stocks lack liquidity, making it hard to buy or sell quickly. Nearly half of the 600+ unlisted shares are not traded regularly, with no buyers or sellers for months, leaving investors stuck without flexibility.

Lack of Transparency – Private companies don’t have to share the same financial details as public ones, which can make it difficult to assess their performance and prospects. These are also not backed by the stock exchanges.

No Analyst Coverage – Pre-IPO companies don’t get the same level of analysis from experts as listed ones do, making it harder to judge the true value and growth potential.

To sum up, IPOs and pre-IPOs can present exciting investment opportunities when backed by strong fundamentals and reasonable valuations but overexposing your portfolio to a few IPOs/pre-IPOs can hamper your long-term financial goals.

Disclaimers:

- Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

- Registration granted by SEBI, membership of BASL and certification from National

Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. - The information is only for consumption by the client and such material should not be redistributed.

- The securities quoted are for illustration only and are not recommendatory.

- This material is for information and educational purposes only.