While investing in equity mutual funds, an investor has a couple of options to choose from. One can invest either in a diversified equity fund or invest in a sectoral or thematic fund. As per the Association of Mutual Funds in India (AMFI), a sectoral fund must invest at least 80% investment in stocks of a particular sector or theme whereas a diversified fund can invest across different sectors and different market capitalizations.

Sectoral funds limit themselves to a particular theme of investing thus limiting diversification and increasing risk. Additionally, sectoral funds go through cycles and these cycles can be longer than expectations which could result in underperformance.

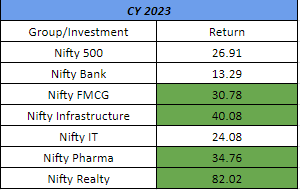

If we look at the near-term returns data it looks like apart from Nifty IT and Nifty banks, most of the popular themes have outperformed the broad-based Nifty 500 index.

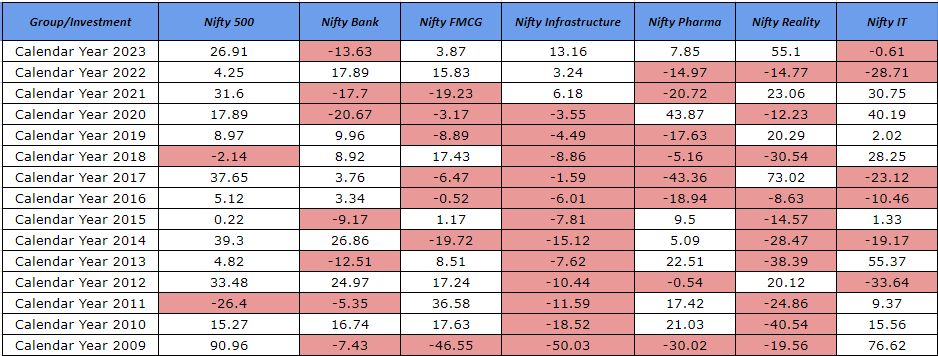

We have presented the calendar year returns data below which compares the performance of the theme versus the Nifty 500 index. If positive, it suggests that in a particular calendar year, the theme has outperformed a broad-based index such as the Nifty 500.

How do we read this table? The table represents relative returns data. For example – Nifty 500 has generated a CY 23 return of 26.91% whilst in the same timeframe the Nifty Bank theme has generated a return of 13.26%, hence as a result the difference mentioned is -13.63% which means Nifty Bank has underperformed Nifty 500.

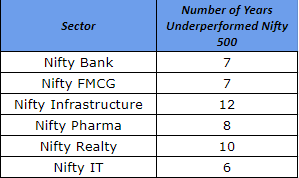

Starting from 2009 to 2023 i.e. in the last 15 years, respective sectoral funds have underperformed the Nifty 500 as below.

From the above data points here are our top three takeaways.

Cycles are longer than expected: Nifty infrastructure has consistently underperformed the Nifty 500 from 2009 to 2020 which is a period of 12 years. Additionally, it’s interesting to note how the length of each cycle differs among sectors. Defensive sectors such as Banks, FMCG, Pharma, and IT have had a slightly lower period of underperformance when compared to capex-heavy sectors such as Infrastructure and Realty.

Valuations: Valuations play a key role while investing in equities. If a sectoral fund has significantly outperformed and if valuations turn expensive, it’s prudent to book profits. Unfortunately, a lot of investors while looking at near-term returns performance could get enticed into the fund which could result in a streak of underperformance. Entry and exit valuations play a key role when entering into a sectoral fund.

Allocation in the portfolio: As a tactical allocation one can look at sectoral funds but the exposure in the portfolio should be limited to 5% to 10%. The core part of the portfolio should contain a diversified portfolio that has the flexibility to invest across sectors and themes and the satellite part of the portfolio could contain sectoral funds. While investing in a sectoral fund one should have a long-term mindset and be prepared for near-term volatility.

The above data is generated in INR, using Morningstar, and returns are calculated are total returns.

Disclaimers:

- Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

- Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The information is only for consumption by the client and such material should not be redistributed.

- The securities quoted are for illustration only and are not recommendatory.

- This material is for information and educational purposes only.