Amid challenges like climate change and inequality, ESG investing blends environmental, social, and governance principles with financial goals, driving ethical wealth creation. Rising awareness of sustainability has popularized concepts like stakeholder capitalism and sustainable investing. Reflecting this trend, global sustainable investing AUM has surpassed $3 trillion and continues to grow. A Morgan Stanley report shows that over 75% of retail investors prioritize investments that balance returns with social and environmental impact.

How to integrate ESG into your investment portfolio by yourself

For investors, selecting ESG strategies can be a challenge. While some can delve into specific company ESG initiatives, investing in ESG mutual funds is another option. Evaluating a company’s ESG commitments is challenging for individuals, but experienced mutual fund managers have the expertise and tools to make more accurate assessments.

ESG funds are investment schemes that select stocks based on companies’ ESG performance. These funds garnered popularity after the COVID-19 pandemic. As of 30th November, there are 10 ESG mutual fund schemes in India, of which one is passively managed and nine are actively managed.

Fund managers evaluate companies’ ESG performance using sustainability data, including Sebi-mandated BRSR reports, or by directly seeking information when reports are unavailable. Each fund has its approach to determining the ESG-compliant organizations. For example, some ESG funds specified that they would employ integration strategies, whilst others would use exclusion strategies. In an integration strategy, the fund considers ESG factors, along with financial ones, while deciding on where to invest. On the other hand, those with exclusion strategies build portfolios by avoiding investments tied to certain ESG activities, business practices, or segments.

Another way of ESG Investing is through fixed income, especially green bonds. Green bonds work like regular bonds with one key difference: the money raised from investors is used exclusively to finance projects that have a positive environmental impact, such as renewable energy and green buildings. Government-issued Sovereign Green Bonds are also an alternative. Although these bonds have high ESG scores they generally provide slightly lower yield compared to traditional bonds.

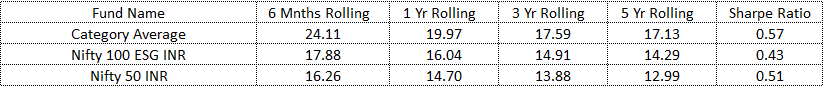

*All the above data are taken from Morningstar Direct and generated in INR. Category Average here is the Morningstar Category Average *

As seen in the table ESG category average has outperformed its benchmark (Nifty 100 ESG), the Nifty 100 ESG Index consistently outperformed the Nifty 50, demonstrating that ESG-compliant companies generate better long-term returns and resilience. According to a Deloitte study, investing with a focus on ESG performance can create value beyond the financial costs involved.

Diversification remains key, even in sustainable portfolios. ESG goals vary for investors, some may prefer only high ESG scores, while others might accept lower scores for higher returns. A balanced portfolio combining stable ESG-compliant companies with high-impact, higher-risk options can align financial goals with meaningful environmental and social contributions.

Risks associated with ESG Investing

Despite growing AUM, ESG investing faces risks like greenwashing due to non-standardized ESG disclosures. Some companies selectively highlight positive practices while concealing negatives. ESG funds may not suit all investors, especially those solely seeking high returns. Assess goals, risk tolerance, and preferences before investing, as ESG funds are yet to navigate a full market cycle.

In conclusion, ESG investing maybe more than just a trend; it’s a paradigm shift in how investors approach wealth creation. Investors can integrate ESG factors into their portfolios through a variety of instruments, including ESG-compliant companies, ESG-focused mutual funds, and green bonds. ESG investing goes beyond just balancing wealth and value – it’s a powerful commitment to shaping a sustainable future for generations to come.

Disclaimers:

- Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

- Registration granted by SEBI, membership of BASL and certification from National

Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. - The information is only for consumption by the client and such material should not be redistributed.

- The securities quoted are for illustration only and are not recommendatory.

- This material is for information and educational purposes only.