“In investing, diversification is the only free lunch. Asset allocation is the decision that determines the most significant part of portfolio risk and return.”

“In investing, diversification is the only free lunch. Asset allocation is the decision that determines the most significant part of portfolio risk and return.”

-Harry Markowitz

Just as variety strengthens an ecosystem, diversity in investing strengthens your portfolio. Investing all your money in one instrument or asset class can expose you to various systematic and unsystematic risks. Asset allocation helps in spreading your investments across different asset classes rather than one, which in turn helps to balance risk and portfolio returns over time.

The goal of asset allocation is to minimize risk while meeting the level of return you expect. Since each asset class carries a different risk profile, diversification across multiple asset types helps mitigate the impact of severe downturns in any one asset class. A portfolio heavily concentrated in a single asset class is vulnerable to large swings in value, which could result in significant losses and gains. In contrast, a well-diversified portfolio is better equipped to handle market volatility. Different asset classes have varying correlations, allowing investors to create portfolios aimed at returns with reduced volatility.

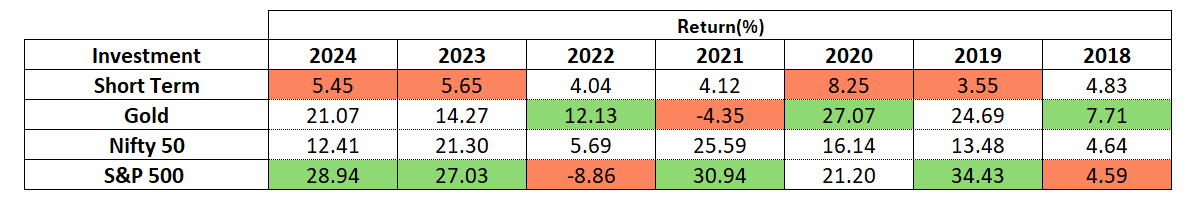

Source for Short term Debt- India Short Duration Fund; Source for Gold- Kotak Gold Dir Fund; Source for all data- Morningstar. All reports are generated in INR. Green indicates highest performance and Red indicates lowest performance.

Source for Short term Debt- India Short Duration Fund; Source for Gold- Kotak Gold Dir Fund; Source for all data- Morningstar. All reports are generated in INR. Green indicates highest performance and Red indicates lowest performance.

Asset allocation helps reduce portfolio volatility by combining assets that don’t always move in the same direction. For instance, from the above table, a portfolio solely invested in the US S&P 500 delivered impressive returns in 2021 compared to a gold-only portfolio. However, in 2022, the same stock-heavy portfolio saw negative returns, while gold performed well. This highlights the importance of a diversified portfolio, as returns from different asset classes can partially offset each other, resulting in more stable overall performance.

Using asset allocation to your advantage

- One of the primary steps in building a portfolio is assessing your risk tolerance as you will calibrate your asset mix based on the amount of risk you are willing to take. An investor’s time horizon and liquidity needs are also key factors that help in evaluating their risk tolerance. In general, securities that provide higher returns tend to be more volatile and riskier, thus one should not expect equity-like returns in a 50% fixed Income and 50% equity portfolio.

- There are circumstances when you may want to adjust your portfolio. Rebalancing is an important process, as it brings discipline and helps you stick to your investment goal. For example, in a bull market, a 50%:50% fixed income and equity portfolio could shift to a 40%:60% fixed income and equity allocation. During such times, rebalancing by reducing equity and increasing debt can help protect the portfolio from capital erosion if a bear market follows.

- During turbulent markets, one of the biggest mistakes that investors make is to view short-term declines in portfolios as “losses” rather than the natural ups and downs of financial markets. Investors can also let fear cause them to be too conservative within their portfolio and miss out on potential long-term growth. Awareness of these behavioral biases can help you prepare for and recognize them so that you can avoid their traps. Clearly defining your investment goals and time horizon can help you visualize long-term goals which help in avoiding short-term deviations. Additionally looking at long-term data on the performance of asset classes would help in decision-making.

To sum it up, it is crucial for investors to get the chemistry of asset allocation right in order to generate optimal returns. Revisiting your portfolio regularly and rebalancing weights are of equal importance. Whilst keeping in mind that emotions will play a role, you should be able to stick to your asset allocation no matter what happens in the markets.

Disclaimers:

- Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

- Registration granted by SEBI, membership of BASL and certification from National

Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. - The information is only for consumption by the client and such material should not be redistributed.

- The securities quoted are for illustration only and are not recommendatory.

- This material is for information and educational purposes only.