As investors increasingly look for strategies that deliver long-term outperformance without the emotional rollercoaster of stock picking, Factor Investing has emerged as a compelling middle ground between passive indexing and active management. But is it right for you?

Let’s explore the answer based on both market behaviour and empirical data.

Every investor has a different approach when it comes to equity investments. Some chase higher returns, while others prioritize safety. The strategies below offer a range of options based on your goals and risk appetite.

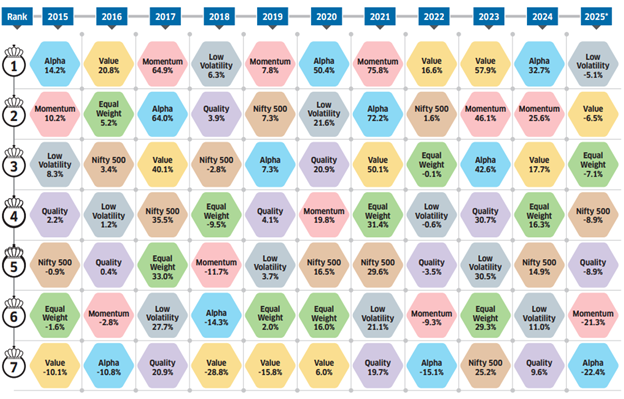

Source: UTI AMC

If you’re an aggressive investor, styles like Momentum and Alpha might appeal to you. These focus on high-growth opportunities, though they often come with higher volatility.

On the other hand, conservative investors may prefer Quality and Low Volatility strategies, which aim to protect capital and provide steady returns, especially during uncertain markets.

Historically, Factor strategies have a well-documented track record of outperforming traditional indices like the Nifty 50 and Nifty 200 over long holding periods. While these factors may underperform during short-term market dislocations, their long-term wealth creation potential is supported by decades of global and Indian data.

Rolling Returns

Source – Morningstar direct

Every factor goes through its cycle of outperformance and underperformance, as you can see below, winners keep changing. This constant rotation makes it incredibly difficult to be in the right factor at the right time.

Since timing the market or predicting trends can be challenging, multi-factor strategies that combine different investment styles help deliver more balanced and consistent returns.

Source: ET Wealth Data as on 8th April 2025

One thing investors also need to note is that different factors outperform in different market phases:

In bearish or flat markets, Quality and Low Volatility tend to outperform by preserving capital.

In moderate uptrends, Momentum and Value begin to take the lead.

In strong bull markets, Value, Momentum, and Alpha-style factors usually deliver the best returns.

So the final question: “Is It Right for You?”

If you seek:

- Long-term outperformance over indices and better risk-adjusted performance

- Broad exposure across sectors and industries to achieve better risk distribution within a single fund.

- Rule-based, clearly defined, and publicly available stock selection process.

- Lower expense ratios compared to actively managed funds: a cost-efficient way to target outperformance.

- Disciplined and transparent approach to nullify emotional bias or inconsistent decision-making.

… then yes, factor Investing could be right for you.

It may not deliver instant gratification, but factor strategies reward the patient investor with consistent, efficient compounding. Factors can be used in addition to passive and active funds in a portfolio.

Disclaimers:

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL and certification from National

Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The information is only for consumption by the client and such material should not be redistributed.

The securities quoted are for illustration only and are not recommendatory.

This material is for information and educational purposes only.