Impact of COVID-19 on Consumption & Savings

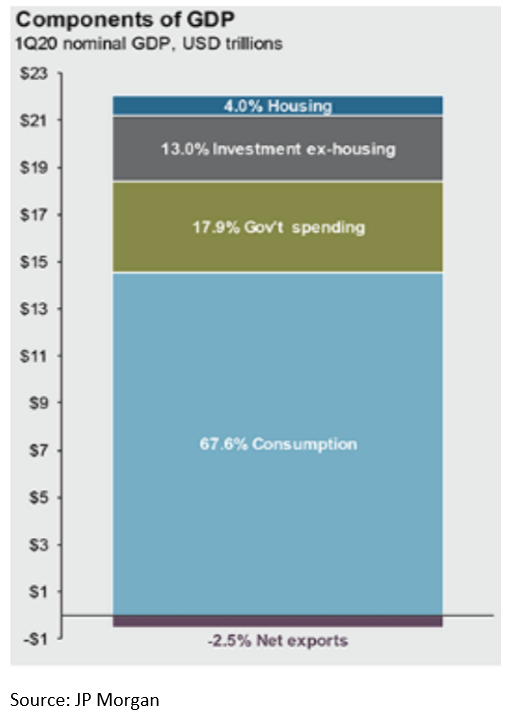

Consumer spending is an integral part of the GDP of many countries across the globe today, and so it is essential to keep it at a high so that the economy of the country is stable. In India, consumer spending makes up about 60% of its GDP, while in the US consumer spending makes up approximately 70% of its GDP.

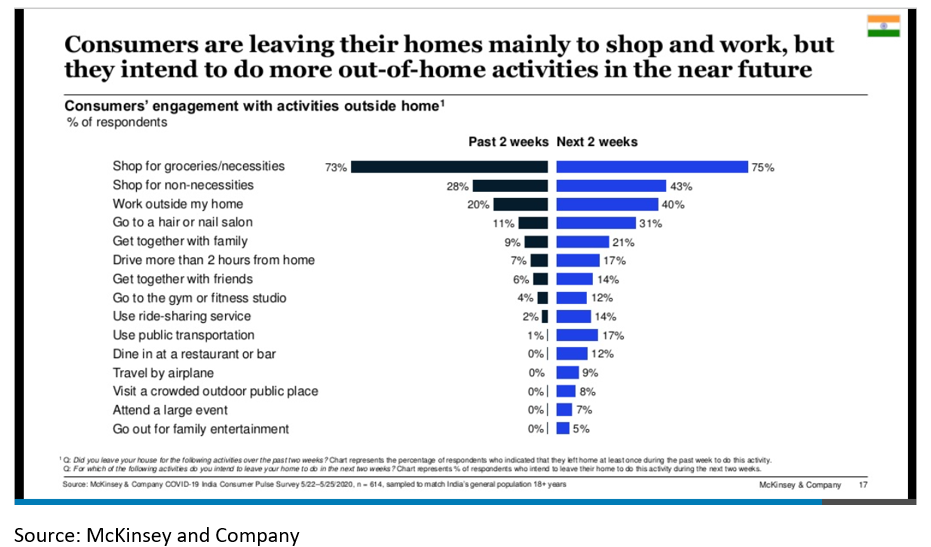

This ongoing pandemic, however, has resulted in a significant decrease in consumer spending in many spaces, though it has also caused an increase in some spaces. With lockdowns happening in most countries, families decreased their spending on non-essentials, and have begun to use their money more prudently. Since families are forced to stay at home, and outside entertainment and recreational facilities closed, spending in this area has become almost negligible. Discretionary spending has gone down which has reduced the overall spending. However, as per an interesting survey, the past two weeks may have been different from how families expect to spend in the next two weeks.

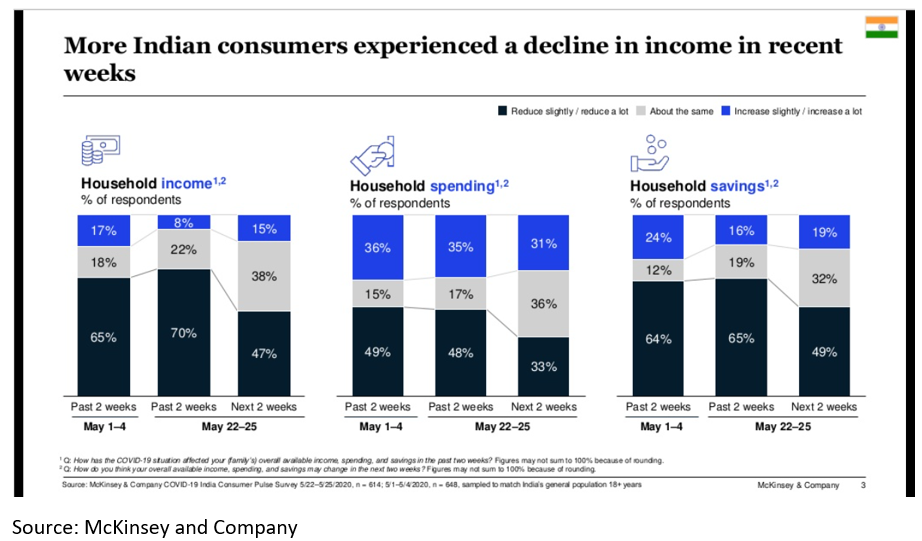

Another major reason for the decrease in consumer spending is the rising rate of unemployment. Millions of individuals have lost their jobs or faced major pay cuts. Since individuals are not receiving their regular amounts of income, spending was bound to reduce. The data below shows how income, spending and savings have changed across households in the last couple of weeks.

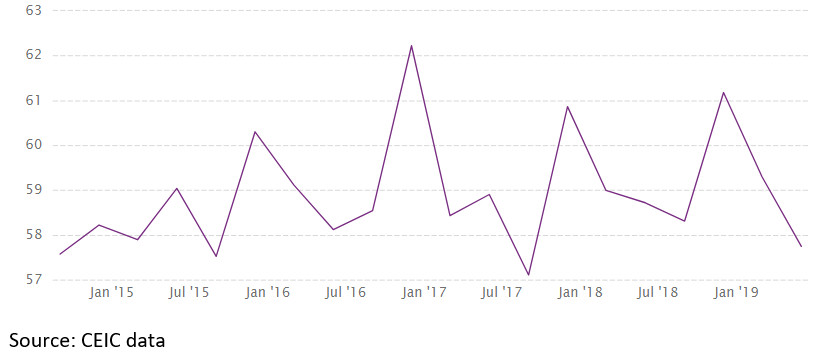

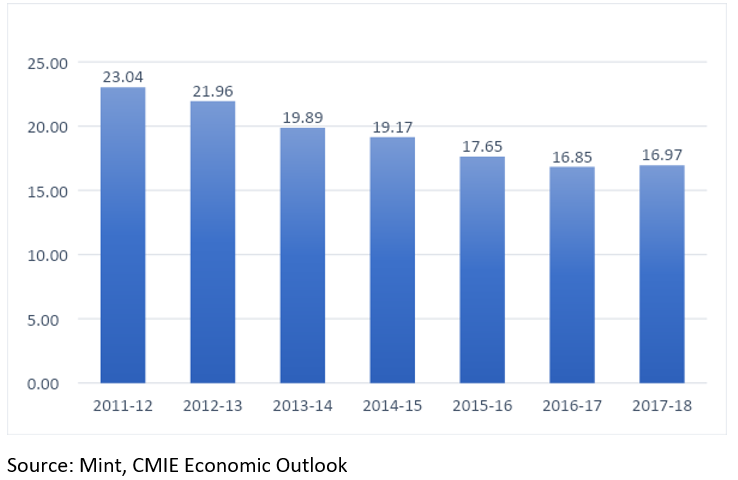

Indian saving rates were on the decline even before the pandemic started and now they have further dropped, thanks to the reduction in household incomes. Savings are also an integral part of the country’s GDP and since saving rates have reduced further, the impact on GDP and the multiplier effect of savings in the economy as these savings could have been put to productive use, could have further impacts. According to CMIE, the decline in the savings rate is primarily due to a decline in household savings. As visible below, household savings rates are falling every year, having fallen a significant 6% in this period of seven years.

The reduction in income has resulted in a decrease in household savings, as families may not be able to compromise on spending on essential items and services, which has caused savings to suffer.

One must keep in mind that not one but both consumption and savings, but both are very important for the economy. Thus, the government needs to take immediate action to increase both of these. The simplest solution would be to increase the income of individual and families, but employers many also not have any money with themselves.

The key to consumer spending is employment. The government needs to urgently create new job opportunities for the unemployed labour force. The government also needs to focus on restarting and supporting small businesses which account for the majority of jobs in most countries, but are the ones particularly vulnerable during this crisis.

So, the government has to transfer money individually to either the employer’s bank accounts or to individual bank accounts. This will encourage them to save as well as spend more. Supply of food grains to the poorer section of society will allow them to spend their money elsewhere and even save some of it.

A reduction in taxes will mean that the people will have a larger disposable income, which could induce more savings as well as more spending. That is why intervention of the government is critical and only then a country’s economy can remain stable during times of a economic crisis.

These initiatives will need to be taken quickly and will need the cooperation of individuals and the companies to keep people employed.

Dhruv Dhawan is a high school science student, currently interning at Plan Ahead Wealth Advisors, and exploring the overlap between social sciences and the impact result of COVID 19 on the world in terms of multiple aspects.