Impact of COVID-19 on Inflation

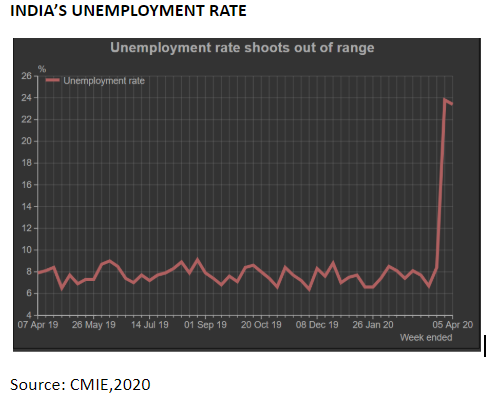

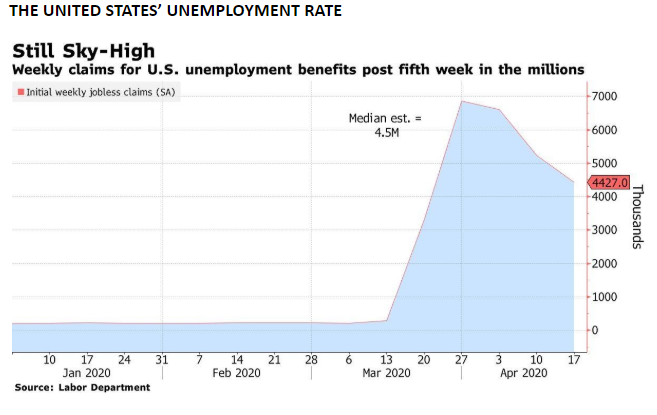

The ongoing pandemic has resulted in a large number of individuals facing pay cuts and losing their jobs due to a number of countries going into lockdown. Inflation tends to have an inverse relationship with unemployment, that is, higher the unemployment, lower the inflation is likely to be, and vice versa. More jobs were lost in India in the last few weeks than anything ever recorded in economic history. According to The Print, the number of “precariat”, i.e. the number of people that are existing without predictability or security , which is affecting their material and psychological welfare in India now may almost be as large as the population of Russia. As you can see from the graphs below, the number of people that have filed for unemployment in the United States and in India is significantly higher than those that filed in 2009 during the Global Financial Crisis.

The unemployment rate has seen a sharp movement upwards to 23.5% in India

Source: Bloomberg, 2020

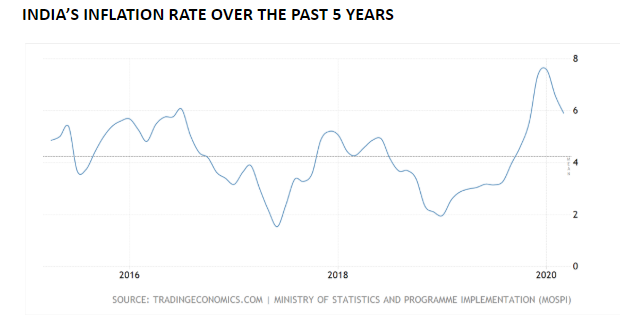

For the past five years, India’s average rate of inflation has been slightly above 4 percent as can be seen in the chat below. In 2017, it fell below 2 percent, but in the last few months there has been drastic rise in inflation of the country. Inflation levels had risen to above 8 percent, but are now starting to slowly reduce once again.

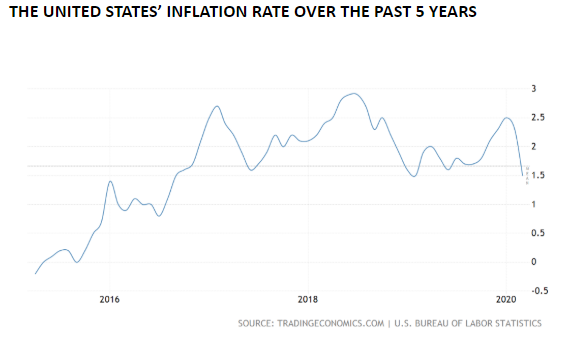

In the United States the inflation rate over the past 5 years has been roughly 1.5 percent, starting with low inflation rates in 2015 and then gradually moving upwards. Both India and the United States work on an inflation targeting mechanism. In India, the RBI is targeting the inflation to be 4+-2 percent while the Federal Reserve in the US is targeting to keep its country’s inflation between 1 and 2 percent.

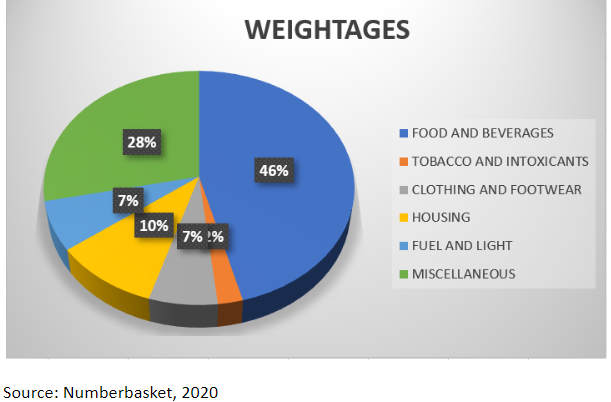

Since India moved to using the Consumer Price Index (CPI) from Wholesale Price Index (WPI), understanding the components of the Indian CPI basket is critical so as to better understand the possible path for inflation going forward basis the COVID 19 pandemic. The India CPI is categorized as below:

Considering the above data, since food is such a significant component in the CPI basket, an increase in the price of food will significantly increase the CPI. The UN recently published a report stating that the governments must keep alive the food supply chain, lest there could be a global food shortage which could result in the prices of food going through the roof. Such a shortage could certainly result in inflation increasing.

At the same time, one also needs to keep in mind that fuel prices have come down sharply due to significant reduction in the demand for oil. Therefore, the OPEC and OPEC+ have cut production by 9.7 million barrels per day from May 1. This could help in keeping inflation under control as the possible reduction in global oil production will keep oil prices and the CPI in check. However, a large portion of this reduction in oil prices could be absorbed by increased taxes to help government finances that have also been hit due to the pandemic.

In addition to this, COVID-19 has resulted in both the residential and commercial real estate sectors being hit in terms of launches, sales and prices, throughout India. Leasing activity is also expected to remain well below par during this period. According to a survey conducted by Knight Frank India, the next six months may be one of the worst phases in terms of new supply additions across the major office markets in the country, with subdued demand. In spite of all these hits to the real estate market throughout the country, since housing takes up only 2% of the county’s CPI, the impact on reduction of CPI may not be that significant.

Besides inflation, two other scenarios could take place across various economies: stagflation and deflation. Stagflation is used to describe an economy that has inflation, a slow or stagnant growth rate, and a relatively high unemployment rate over a longer period of time. On the other hand, deflation is a general decline in prices for goods and services, due to either an increase in the productivity and the abundance of goods and services or due to a decrease in the aggregate demand. As a result of this pandemic, there has been a supply as well as demand shock which has rapidly increased the unemployment rate and has triggered a large economic recession throughout the globe. However, since there is a decrease in the demand as well as supply, we should not expect to see deflation that occurred during the Great Depression and the Global Financial Crisis as a base case.

One could, however, expect stagflation to occur as the demand for resources such as food has gone up due to people hoarding food which could lead to an increase in their prices. Since food holds a lot of weightage in the CPI basket, inflation could be expected to take place at a higher rate. If stagflation were to continue for a longer period, the aggregate demand could decrease resulting in economies going into deflation. This would result in economies receding even further and so governments need to take necessary action immediately. This could happen by decreasing the unemployment rate by increasing government spending, introducing more job opportunities for people and examining ways to get Indian MSMEs to start working again.

The future outlook for inflation is likely to be driven by food, and thus extra focus on this space by the government may be critical in this phase.

Dhruv Dhawan is a high school science student, currently interning at Plan Ahead Wealth Advisors, and exploring the overlap between social sciences and the impact result of COVID 19 on the world in terms of multiple aspects.