Impact of COVID-19 on World GDP

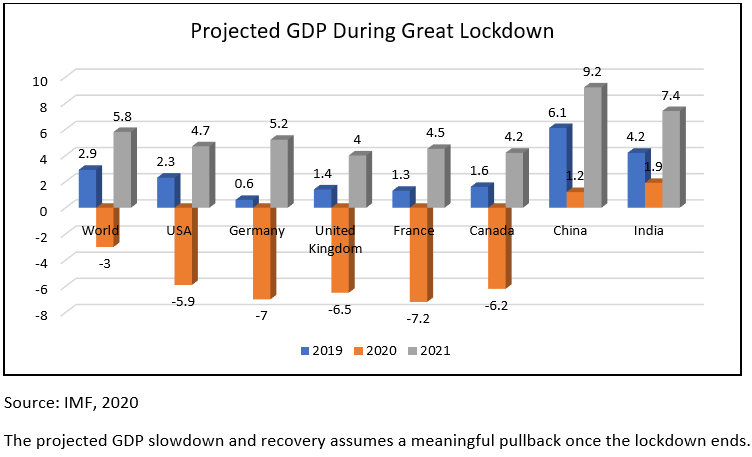

The world is now seeing an unprecedented lockdown due to COVID-19. This health crisis has resulted in both a possible serious economic crisis impacting both individuals and businesses across the world, as well as a steep fall in global financial markets. In a recent report published by the IMF, the IMF has indicated that the current crisis is the worst recession since the Great Depression (1929-1933) , and is far worse than the Global Financial Crisis (2007-2009). The IMF indicated that assuming the pandemic recedes in the second half of the year, the global growth in 2020 is projected to fall to -3 percent. This is a fall of 6.3 percent from the projections made for global growth in January 2020, which is a very sharp fall in such a small period of time. This is clearly a black swan situation and such a drastic change has not been witnessed for a considerable period of time. A sharp growth slowdown has resulted in a significant shift in the business cycle, with economies slipping into recession which could be followed by a depression if governments do not act fast to arrest the same.

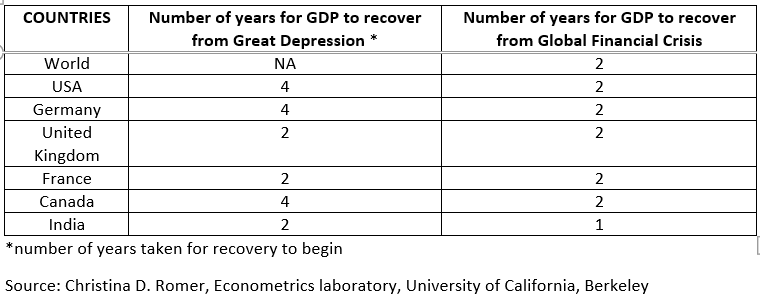

The table below shows the years taken for each of country to initiate recovery from the Great Depression and the Global Financial Crisis. Of course, only time will tell how much time it will take for the world to recover from this pandemic.

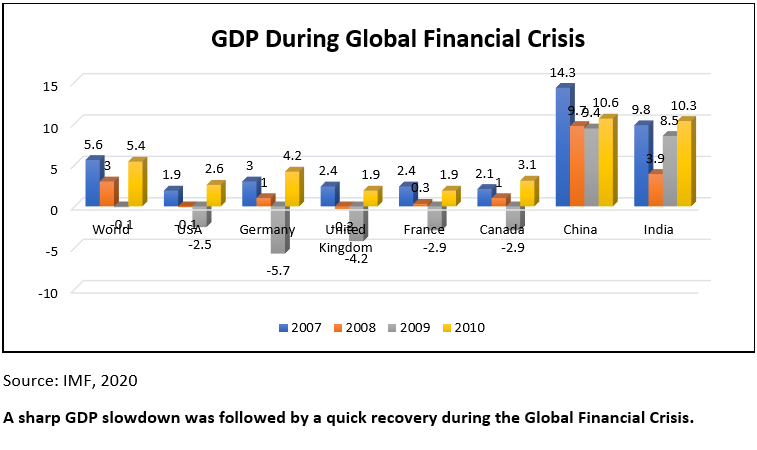

Multiple comparisons are also being made to the Global Financial Crisis in 2007-08 at this point, as that was the last severe crisis that the globe had seen. Illustrated below are how the GDP was affected during the Global Financial Crisis, and how they are projected to get affected post the Great Lockdown. What is of particular interest is also how things came back post the Global Financial crisis.

As you will see from the table above, whilst other countries took 2 years to recover from the Global Financial Crisis, India took only a year. This was due to the significant fiscal stimulus that was applied during the period.

IMPACT

This pandemic has instilled a sense of fear in the people of losing their jobs, facing salary cuts or salary delays. This has reduced consumer spending in most categories like public transit and retail spending by a big margin, but has remained the same for categories like food, groceries and medicines in anticipation of a lockdown. Consumer spending is likely to remain low going forward due to income related risks. When pandemic strikes, people focus more on saving and accumulation of wealth rather than on consumption, due to uncertain flow of income.

According to Keynesians, consumer demand is the primary driving force in an economy, and so necessary measures such as tax cuts, and an increase in government spending would help to stimulate consumer spending and also promote investment spending with a lag by the private sector. All around the world, governments are looking to improve the situation by taking required measures, such as investing heavily to improve healthcare infrastructure and medical equipment. They are also likely to invest more on infrastructure to create more jobs to bring down the unemployment rate which in turn should ultimately increase consumer spending.

In March, China’s exports fell by 6.6% whilst imports fell by 0.9%. India’s exports fell by 1.3% and imports fell by 6.3%, and US exports slipped by 0.4% and imports slipped by 2.5%. According to the World Trade Organization, world trade is expected to fall by between 13% and 32% in 2020. Even though the impact of the COVID-19 outbreak on international trade is not yet visible to a great extent, the trade data going forward could reflect a much steeper decline.

We need to keep in mind that all projections on GDP going forward will be based on how the healthcare system is able to deal with the COVID-19 cases and how the various measures taken by the government once the lockdown opens up gradually, pan out. One also needs to keep in mind that the recurrence of cases will drive future behaviour of various economies. Thus, the GDP projections and resultant impacts on global economies will be closely watched going forward.

Dhruv Dhawan is a high school science student, currently interning at Plan Ahead Wealth Advisors, and exploring the overlap between social sciences and the impact result of COVID 19 on the world in terms of multiple aspects.