India’s capital markets are reaching new highs as foreign money continues to flow into markets, as India has become the fastest-growing emerging economy in an otherwise slow economic environment. As a result of this frenzy, we are witnessing equity markets scaling new highs.

In high-market scenarios, portfolio management theory seems to suggest that one should focus on asset allocation and not where Mr. Market is headed!

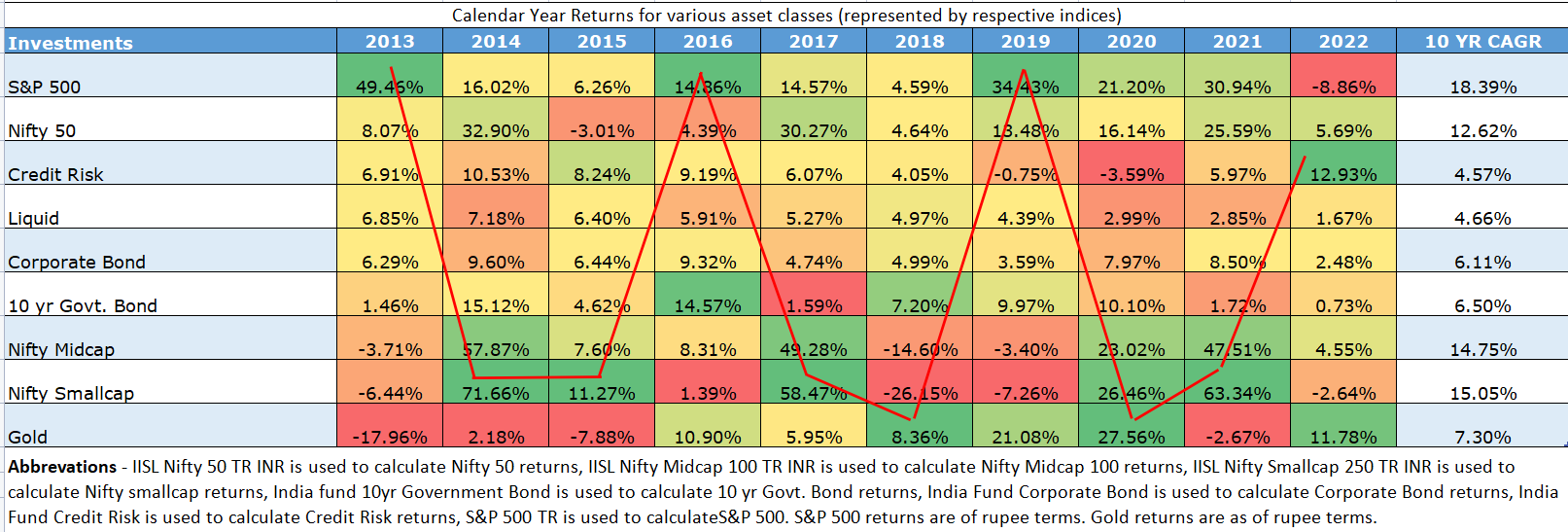

Winners keep changing across the Asset classes

From the above quilt, if you follow the red line, you can see that no asset class is a winner across all the time frames. For Example, if S&P 500 was the winner in 2013 that doesn’t suggest that it will remain so in the future years.

If one had invested only in Nifty 50 in 2013 he would have earned 8.07% in 2013 and 33% in 2014, However for the next 2 years 2015 and 2016 he would have seen his portfolio decline by 3% and underperform the market by just generating 4.4% in 2016. This example suggests that one should not put all his eggs in one basket.

Let us, therefore, examine how asset allocation works, and does it help in return optimization?.

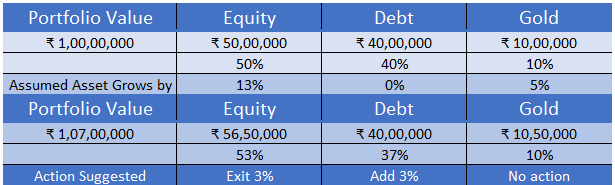

According to Mr. A’s risk profile, his ideal portfolio mix should be 50% Equity, 40% Debt, and 10% gold. In this example, as the equity markets have rallied the weightage of equity in the portfolio has increased from 50% to 53%, so Mr. A should book some profits in equity and invest the same in debt which will bring his portfolio to the ideal mix.

Following his asset allocation helped the investor to book profits on a timely basis and re-deploy the proceeds in debt, thereby adding discipline to his investment management.

Most times, as investors we expect markets to go higher, and if suggested to reduce equity assets allocation, greed comes into play as the markets are scaling new highs. As a result of this, instead of exiting equities, one may even move monies from debt, FDs (Fixed Deposits) & Gold and re-invest the same into equities, doing quite the opposite due to emotional reasons, thereby letting the asset allocation mix go astray.

Asset allocation is one of the foundation pillars when one thinks of optimal assets and returns from there. An individual’s asset allocation is decided after considering various factors such as risk appetite, risk tolerance, life goals, biases, and investment time horizon. Asset allocation not only captures these factors but also provides a healthy mix of aggressive and defensive assets an investor may hold in order to be comfortable with the risk in his portfolio.

As different asset classes perform differently during different time periods, one needs a simple method to understand when to hold or exit from certain asset classes. Following an agreed asset allocation allows one to do so.

Below are some pointers you should remember about asset allocation:

- Asset Allocation helps to optimize the returns of a portfolio as it indicates when to exit (usually at a high)

- It serves as a guideline to rebalance the portfolio and adds discipline and removes emotional biases.

- It helps diversify the risk as via asset allocation one’s portfolio would be diversified across many asset classes and not concentrated in one asset class

- It aids funding goals and milestones as a prudent asset allocation framework would suggest a glide path for upcoming funding needs

Focusing on asset allocation therefore does have many merits, so remember not to forget your agreed asset mix, while tracking the market highs.

Standard warning: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory. This information is only for consumption by the blog reader and such material should not be redistributed.