Over the past few weeks, newspaper and business channels have been cheering the fact that Indian equity markets have touched lifetime highs. The most common reasons that you may be hearing of are FIIs (Foreign Institutional Investors) pouring money due to the solid macro-fundamental story, continued DII (Domestic Institutional Investors) flows & resilient domestic demand.

In the current situation, investors seem to be influenced by the market performance on a short-term time frame like the last 3 months, and also on a year-to-date basis. We are finding investors are possibly viewing performance over a short-term time frame and are becoming aggressive and increasing the equity exposure and risk in the portfolio in order to chase higher returns.

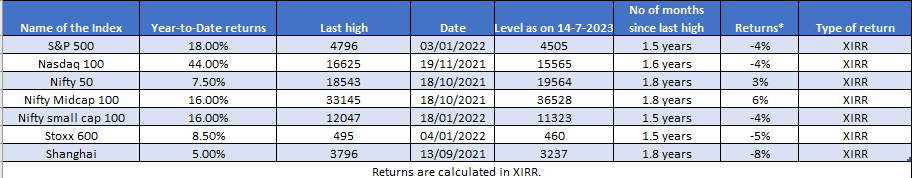

Even though Indian markets have reached new highs, if one compares the returns of most markets from previous highs to current highs, one will note that most of the markets are either trading below their all-time highs or have given single-digit returns in the last year and nine months since October 2021. For instance, the Nifty 50 reached a level of 18543 on 18th October 2021 and as on 14th July 2023, it was trading at a level of 19564 which means that the Nifty 50 index has not delivered the amazing returns that one is imagining, but just about 3% pa in the time between the October 2021 and now. (see table)

Source- Investing.com

Source- Investing.com

Similarly, if one sees the above chart, other markets like NASDAQ 100, Shanghai, STOXX 600, and Nifty Smallcap indices, all of them are trading below their peak levels in the returns range of -4% to – 8% in a similar time period since October 2021.

What should one do in the current situation when markets are seeming high?

We are currently experiencing euphoria in the market as everyone is chasing returns while ignoring the valuations – this is also evident as we can currently see midcap stocks trading at a significant premium to their larger counterparts.

However, investment principles suggest that one should not take investment decisions purely based on market momentum as it can trap you at higher market levels.

So, what one should take into consideration while making investment decisions at these current levels? We discuss some points you should consider before investing at current market levels:

- Compare the current valuations with their long-term averages to see whether the markets are rightly valued, undervalued, or overvalued.

- Do not take investment decisions based on short-term performance like year-to-date performance or 3 months performance as it can be quite deceptive and as a result of this, you may jeopardize your asset allocation.

- Do not increase the incremental risk in the portfolio without understanding the implications – the incremental risk may not help you to earn extra returns.

- Do partial profit booking from the market which will help you to re-balance the portfolio, meet your asset allocations and help to re-deploy cash once the market corrects.

- If your major financial goals like retirement, child’s education, or child’s marriage are nearing, then you should choose to glide out of aggressive assets and not be swayed by the greed of staying invested in equities.

- Don’t enter or exit the market, just because markets have made new highs as taking this sort of decision is like timing the market – a game which few may win. It’s better to stay invested in the markets and exit depending on goal funding, milestones, and asset rebalancing needs.

The current headlines may be a case of more noise, and one should try to ignore this noise. This could help you manage your investments better.

Standard warning: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from National Institute of Securities Markets (NISM) in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The securities quoted are for illustration only and are not recommendatory. This information is only for consumption by the blog reader and such material should not be redistributed.